Why Car Ownership in Singapore is an Extravagance

Car ownership in Singapore is notoriously expensive. Explore the reasons why owning a car in the country is considered a luxury.

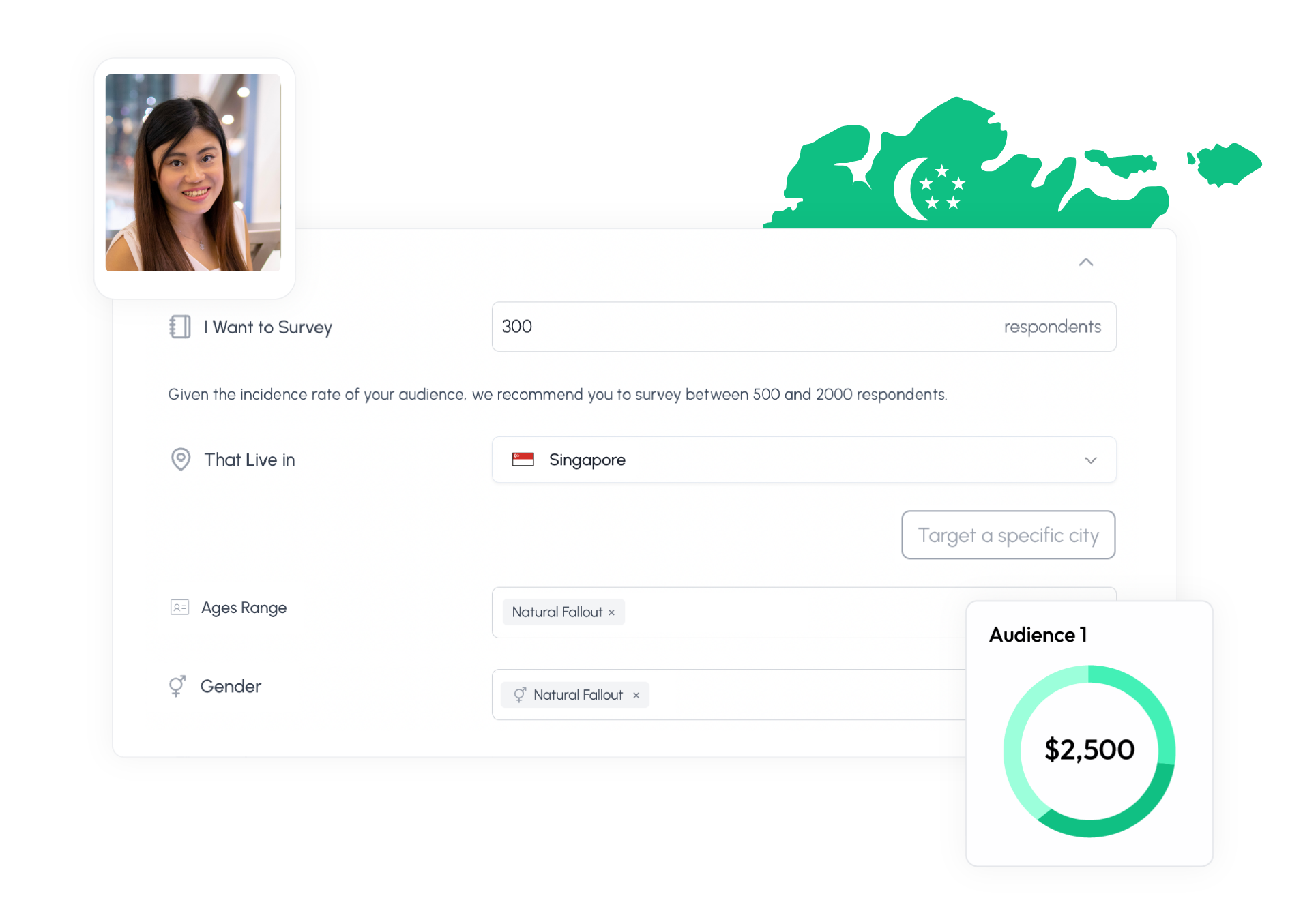

Begin your market research in Singapore and easily collect, analyze, and report data with just a few clicks.

Trusted by

Use our survey builder to recruit respondents from anywhere in Singapore or bring in your own respondents.

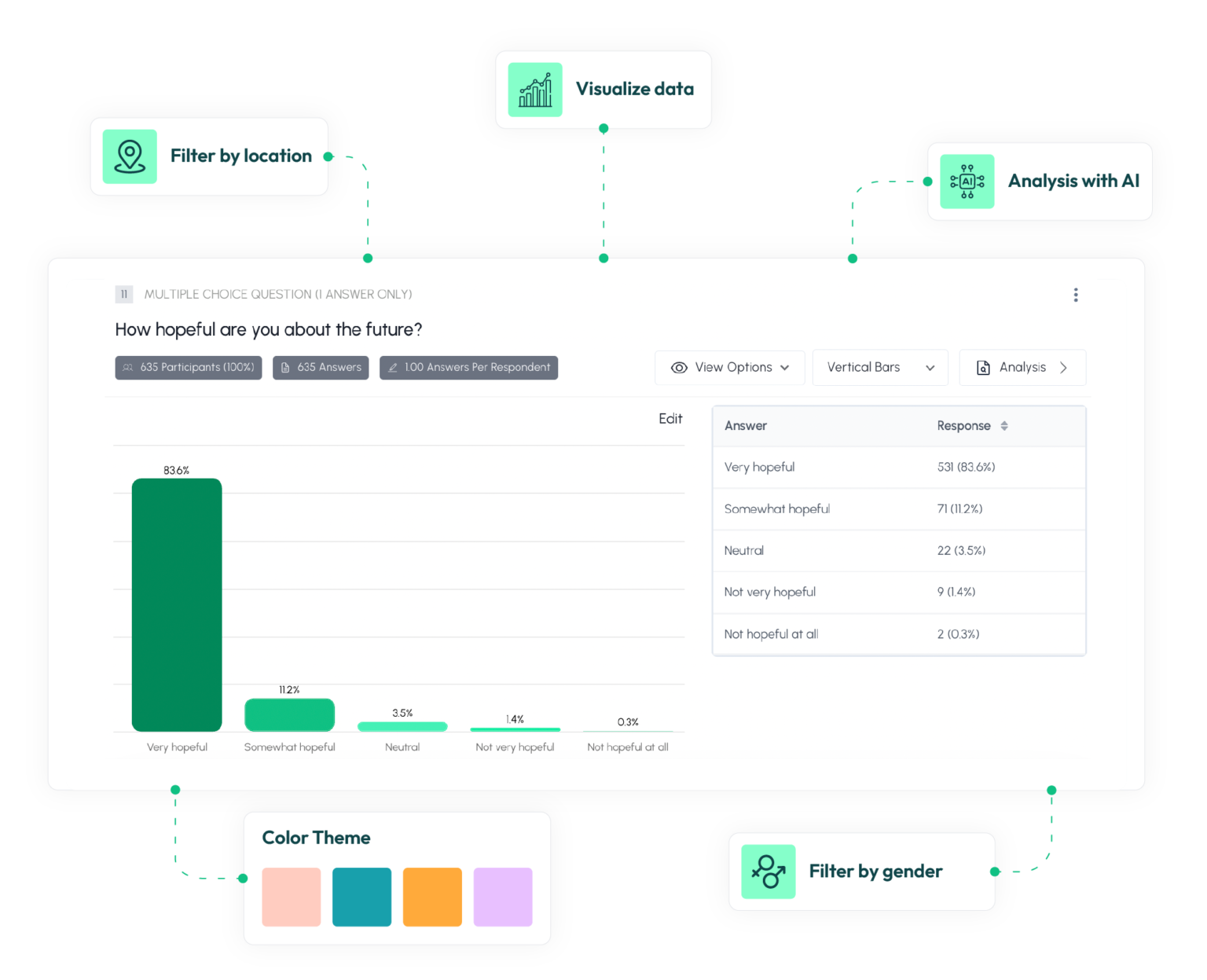

Import your existing surveys and interviews, and have them automatically visualized in a customizable report.

Singapore is a major financial hub in the Asia-Pacific region, blending free-market principles with government intervention, innovation, and efficiency. It has transitioned from manufacturing to a services-driven economy, supported by initiatives like the Research, Innovation, and Enterprise (RIE) 2025 plan.

Despite a slowdown in growth to 1.1 per cent in 2023 from 3.8 per cent in 2022, as reported by the Ministry of Trade and Industry, Singapore remains resilient. It leverages technology and global partnerships, addressing challenges like an aging population through strategies like the Singapore Budget 2023. The economy exceeded forecasts in 2024, reaching 4.4 per cent growth, as noted by Channel News Asia.

Despite its limited domestic market, Singapore has become a global trade powerhouse. The country has aggressively pursued free trade agreements, including 27 FTAs such as the Regional Comprehensive Economic Partnership (RCEP), which covers 30% of global GDP. These agreements reduce tariffs, streamline customs, and enhance market access, supporting exports like electronics, pharmaceuticals, and chemicals. Singapore’s trade-to-GDP ratio remains one of the highest globally, reaching 311.24% in 2023.

The Port of Singapore further solidifies its role as a global maritime hub by leveraging its strategic location along major shipping routes. It facilitates transshipment and redistribution of goods worldwide while fostering collaborations through initiatives like the ASEAN Single Window. Investments in infrastructure, such as the Tuas Mega Port project, and emerging technologies ensure Singapore maintains its competitive edge in global logistics.

Singapore’s tourism sector is a vital economic pillar, traditionally contributing around 4% to the country’s GDP. It thrives on its reputation as a clean, safe, and efficient metropolis that seamlessly blends modern marvels with rich cultural heritage. From the iconic Marina Bay skyline to revered Buddhist temples, Singapore offers a captivating mix of experiences for visitors. World-class attractions like Gardens by the Bay and Sentosa Island further solidify its position as a must-visit destination in Southeast Asia.

In recent years, Singapore has seen significant growth in tourism. In 2024, international visitor arrivals reached 16.5 million, marking a 21% increase from the previous year, with tourism receipts likely to exceed previous records, as reported by the Singapore Tourism Board. For 2025, Singapore is projected to welcome between 17 million to 18.5 million visitors, with tourism spending expected to reach a new high of $29 billion to $30.5 billion, surpassing pre-pandemic levels, according to The Business Times. New attractions like Minion Land at Universal Studios Singapore and Rainforest Wild Asia are set to drive further tourism growth.

At the beginning of 2024, Singapore boasted 5.79 million internet users, reflecting a remarkable penetration rate of 96.0 percent. Singaporeans are highly connected, averaging 7 hours daily on the internet, a significant 22 minutes more than the global average of 6 hours and 37 minutes. This extended internet usage could be attributed to several factors, including Singapore’s high mobile and internet penetration, a thriving e-commerce landscape, or a population that embraces online entertainment and social media platforms.

As of January 2024, Singapore had 5.13 million social media users, representing 85.0% of the population. This high penetration is likely fueled by Singapore’s world-class internet speeds, which facilitate convenient daily use of social media platforms.

Data suggests a shift in user preferences among younger demographics. While WhatsApp remains the most popular platform overall, Facebook appears to be experiencing a decline in younger users. This age group gravitates more towards platforms like Instagram, Snapchat, and TikTok, which offer a more visually-focused and interactive experience.

Explore our previous reports from Singapore to gain insights into consumer trends and behaviors

Car ownership in Singapore is notoriously expensive. Explore the reasons why owning a car in the country is considered a luxury.

Learn how an FMCG company consulted with Standard Insights in using market research on brand positioning in 7 Asian countries.

Learn how iHerb used market research to refine strategies in Singapore and Malaysia’s health sector.

Some of the leading news and media outlets in Singapore

Create your free account and use our set of tools to conduct your research easily.