Indonesia is the largest eCommerce market in Southeast Asia and continues to grow rapidly. With a large population and increasing internet usage, the eCommerce landscape in Indonesia offers businesses unprecedented opportunities to connect with customers.

But what are the key attitudes and behaviors of online shoppers in Indonesia?

To gain a deeper understanding of the eCommerce industry, we surveyed over 1,000 Indonesians about their online shopping habits:

- How often they shop online—and why fashion tops their carts.

- What makes them trust (or abandon) an eCommerce site?

- Whether delivery delays and data fears outweigh convenience.

Discover their insights in the following section, or dive into the complete data in our Consumer Report Indonesia 2023.

The Growth of eCommerce in Indonesia

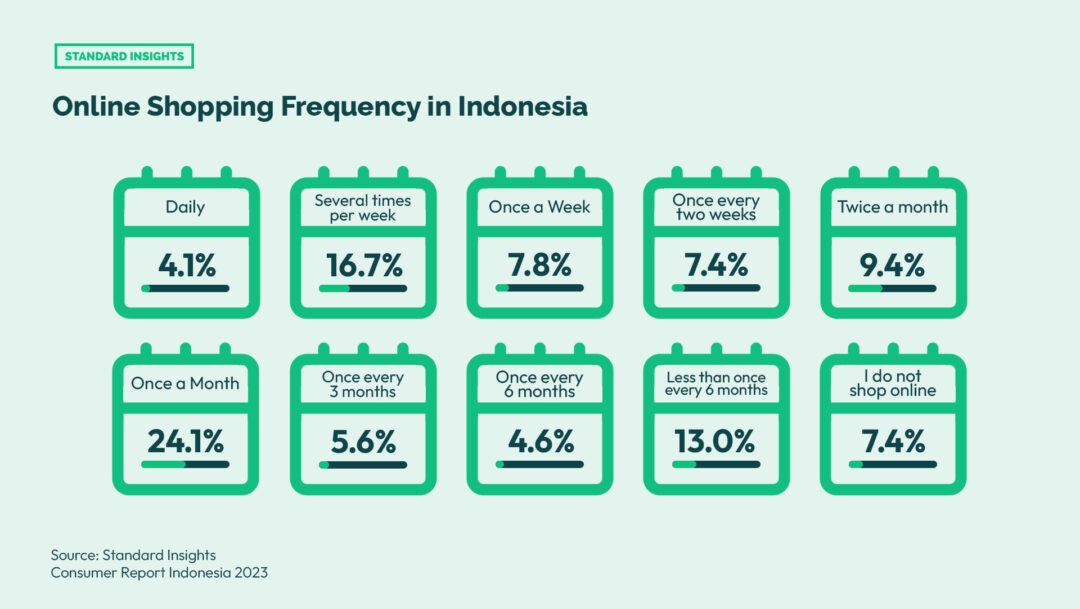

eCommerce in Indonesia has experienced substantial growth and is poised to continue its upward trajectory in the coming years. As of 2024, the market is valued at $68.5B (ITA), up from $43B in 2021., making it the eighth largest in the world. During 2023, the thriving eCommerce sector saw a 23% increase in online transactions and welcomed around 63 million new users. Our survey revealed that over 69% of respondents shop online at least once a month. This showcases a highly active online shopping community in Indonesia.

When it comes to product preferences, the majority of respondents (70.13%) indicated that they enjoy buying fashion items, such as apparel and footwear. This trend holds true across all genders, age groups, and regions surveyed. Following fashion, beauty and personal care products (49.7%) ranked second, while food and beverage items (40.8%) came in third.

What are the top eCommerce sites in Indonesia?

Indonesia’s eCommerce sector is booming, with $68.5B in revenue in 2024, but it’s also fiercely competitive. While Shopee and Tokopedia dominate with 71% of 2022 GMV, niche players like Bhinneka (B2B tech) and Zalora (fashion) thrive by targeting underserved segments.

This table ranks Indonesia’s top eCommerce platforms by monthly web traffic (August 2024 source (ITA, TMO) and historical GMV contributions, revealing key insights:

- Market Polarization: The top 2 platforms (Shopee, Tokopedia) drive 71% of 2022 GMV, while smaller players fight for scraps.

- Traffic ≠ Revenue: Blibli.com, despite ranking 3rd in traffic, claimed the highest 2023 revenue—a testament to premium product focus.

- B2B’s Quiet Rise: Platforms like Ralali and Bhinneka prove specialized B2B marketplaces can thrive despite modest visitor counts.

| Rank | Website | Description |

|---|---|---|

| 1 | Shopee ID | Largest eCommerce platform in Indonesia and Southeast Asia with 227.6M monthly visits (web) in August 2024. Contributed 36% of total GMV in 2022. |

| 2 | Tokopedia | A local multi-vendor marketplace with 95.6M monthly visits (web) in August 2024. Contributed 35% of total GMV in 2022. |

| 3 | Blibli | Had 23.1M monthly visits (web) in August 2024. In 2023, Blibli.com had the highest revenue in the Indonesian eCommerce market. Contributed 4% of total GMV in 2022. |

| 4 | Lazada ID | Online department store and marketplace with 43.6M monthly visits (web) in August 2024. Contributed 10% of total GMV in 2022. |

| 5 | Bukalapak | An Indonesia-native platform mainly catering to small and medium enterprises (SMEs) with 4.2M monthly visits (web) in August 2024. Contributed 10% of total GMV in 2022. |

| 6 | Zalora ID | Singapore-based fashion and cosmetics retailer with 2.2M monthly visits (web) in August 2024. |

| 7 | Bhinneka | Focuses on B2B sales of computers, laptops, gadgets, home appliances, and accessories with 1.5M monthly visits (web) in August 2024. |

| 8 | Ralali | A local B2B marketplace listing over 3,000 product categories from 12 industries with 45.3K monthly visits (web) in August 2024. |

Why is eCommerce Booming in Indonesia?

The eCommerce industry has become a vital component of Indonesia’s economy, providing a platform for entrepreneurs to start businesses with minimal capital expenditure. Key drivers of this rapid expansion include COVID-19 restrictions, increased internet access, and smartphone penetration. As more people gain online access, eCommerce can leverage economies of scale to offer a wider array of products and services.

1. Large Population and Rising Internet Usage

Indonesia is home to a large population of over 270 million people and has seen an impressive rise in internet usage in the past few years. In fact, according to recent figures, Indonesia had 204.7 million internet users in January 2022, with an internet penetration rate of 73.7% at the start of 2022.

This growing online presence has been instrumental in driving eCommerce growth in Indonesia, as businesses have been able to reach out to more customers with eCommerce solutions that are tailored to their needs.

According to our survey, 64.5% of Indonesians find social media sites such as Facebook, Instagram, and TikTok as the most powerful sources of information impacting their online purchase decisions. Website reviews (61.9%) and the brand’s official website (40.6%) are also important information sources for Indonesians.

2. Wide Range of eCommerce Payment Options and Digital Wallets

Indonesia offers a diverse array of eCommerce payment options, simplifying transactions for businesses and consumers alike. Payment methods include bank transfers and e-wallets such as GoPay, OVO, DANA, LinkAja, and Jenius. These e-wallets, often linked to specific eCommerce platforms, have gained popularity, providing customers with a secure, convenient way to make payments.

The proliferation of these payment options has been a major contributor to the eCommerce boom, enabling businesses to reach a larger customer base and making online purchases more accessible.

3. Increasing Competition Among Businesses and Investment and Innovation in eCommerce Solutions

Businesses in Indonesia are increasingly looking to eCommerce solutions as a means of staying ahead of the competition. Platforms like Shopify, Amazon, and Tokopedia have made it easier for businesses to create eCommerce websites that enable customers to make purchases online. What’s more, these eCommerce platforms serve as all-in-one solutions for businesses, providing a range of tools and resources to manage and optimize their online stores. With these all-in-one solutions, businesses can improve their online sales processes, enhance their customer experiences, and unlock new revenue opportunities.

4 Potential Risks & Challenges Associated with eCommerce in Indonesia

1. Poor Infrastructure

One of the primary challenges of eCommerce in Indonesia is the country’s poor infrastructure, especially in remote areas. This poses a significant hurdle to eCommerce players, as it affects the speed and quality of delivery, which directly impacts the customer experience. The government has made efforts to improve infrastructure, but eCommerce companies may have to invest in their own logistics network to ensure timely delivery.

2. Lack of eCommerce Expertise

eCommerce businesses in Indonesia may struggle to find eCommerce experts who can help them develop the right eCommerce strategies and solutions for their business. It is therefore important for eCommerce businesses to invest in training resources and technologies that will help them stay up to date with eCommerce trends and develop eCommerce strategies that will help them remain competitive in the eCommerce market.

3. Fraudulent Activities

eCommerce businesses in Indonesia may be vulnerable to fraudulent activities such as credit card fraud, online scams, identity theft, and other cybercrimes. To mitigate these risks, eCommerce businesses may want to prioritize investing in secure payment methods and establish robust customer service initiatives, such as providing customer support and product guarantees.

These concerns are reflected in the same Standard Insights report, which listed safety and security issues (31.4%) and personal data breaches (9.8%) as two of the most significant challenges faced by Indonesian internet buyers.

Consequently, when asked about their feelings about sharing personal data when shopping online, 43.2% of Indonesians indicated they are comfortable with giving only the most basic information about themselves so that the item/s may be delivered successfully. Meanwhile, 30.5% of them want to be informed and have control over the personal information they gather and store.

4. Competition

eCommerce businesses in Indonesia face stiff competition from eCommerce giants like Amazon and Tokopedia, which can make it difficult for eCommerce businesses to stand out from the crowd.

One key aspect for eCommerce businesses is to prioritize the development of unique eCommerce solutions that can offer their customers a distinctive shopping experience. Along with that, it’s also important to devise effective marketing strategies that can foster brand recognition and customer loyalty.

The Future of eCommerce in Indonesia

Indonesia’s eCommerce sector is on track to triple its value to $220–360 billion by 2030, but success will hinge on balancing rapid innovation with local realities.

The Good: Mobile-first shoppers (67% of transactions), live commerce (7x sales boosts), and events like Harbolnas ($1.93B in 2024 sales) prove Indonesians are all-in on digital. Government-backed initiatives and TikTok-Tokopedia’s MSME partnerships further fuel optimism.

The Hurdles: Limited banking access (54% banked), logistical gaps outside Java, and fierce platform loyalty battles demand creative solutions.

The Winners will be those blending global tech (AI personalization, AR try-ons) with hyper-local nuance—think GoPay integrations for rural COD users or cloud-powered supply chains for outer islands.

One thing’s certain: Indonesia isn’t just Southeast Asia’s eCommerce leader—it’s a blueprint for how emerging markets will shop tomorrow.