The US skincare and cosmetics industry grew by 4% in 2022, reaching $30 billion in sales despite inflation. On average, Americans spend $722 annually on appearance-related products, with skincare, haircare, and makeup topping the list, per Advanced Dermatology.

To understand shifting consumer habits, Standard Insights surveyed 400+ Americans in 2023. Here’s what we learned.

US Skincare & Cosmetics: Beauty Shopping Habits

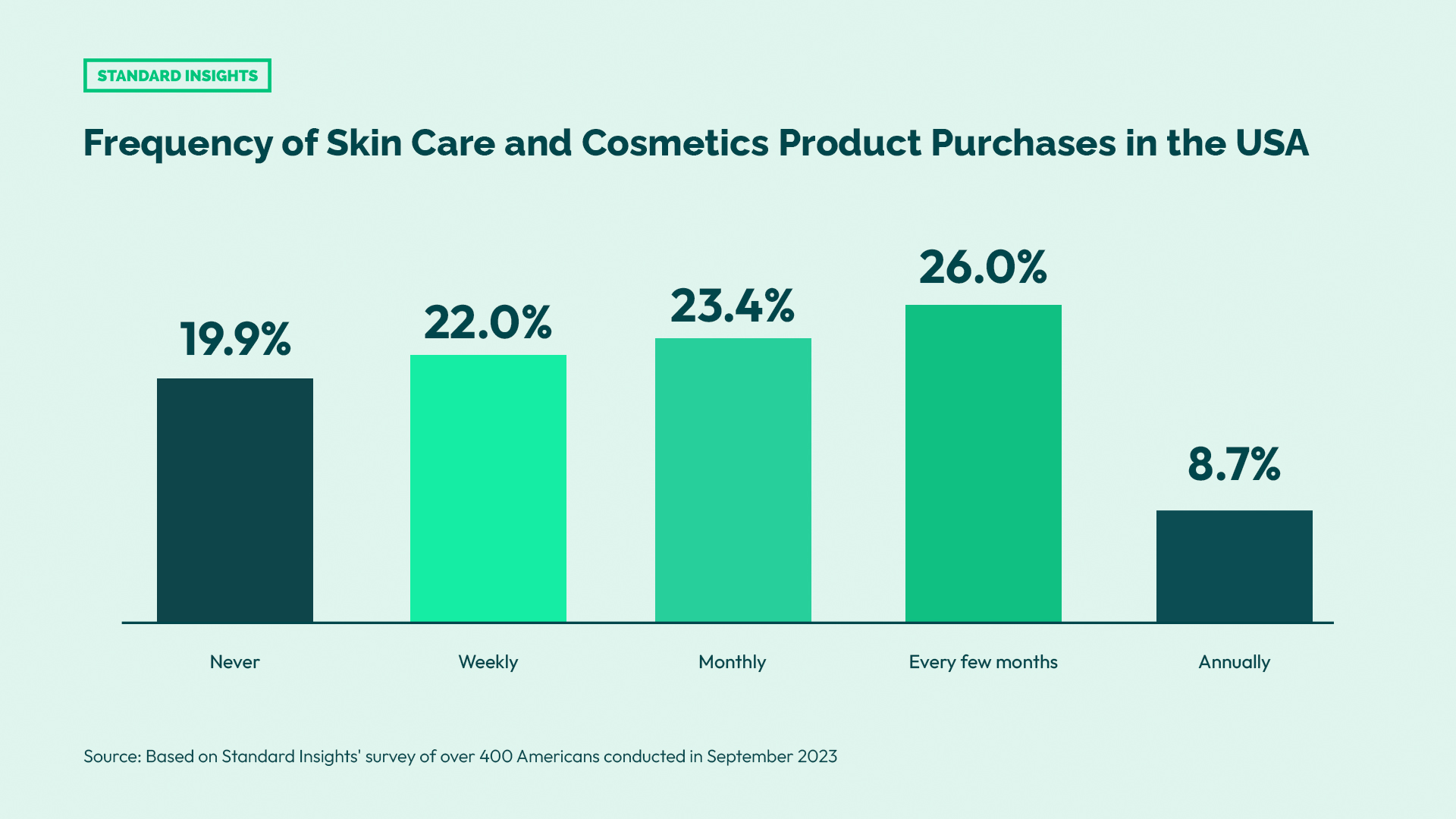

Beauty shopping is part of the monthly routine of 23.4% of Americans, while 26% prefer shopping every few months to keep their beauty collections fresh and updated.

For the beauty enthusiasts, a remarkable 22% indulge in weekly beauty hauls to stay abreast of the latest trends.

On the other hand, 8.7% of Americans choose to stock up on skincare and cosmetics only once a year, indicating less frequent purchasing habits. Nearly 20% of Americans revealed that they never buy skincare or cosmetics.

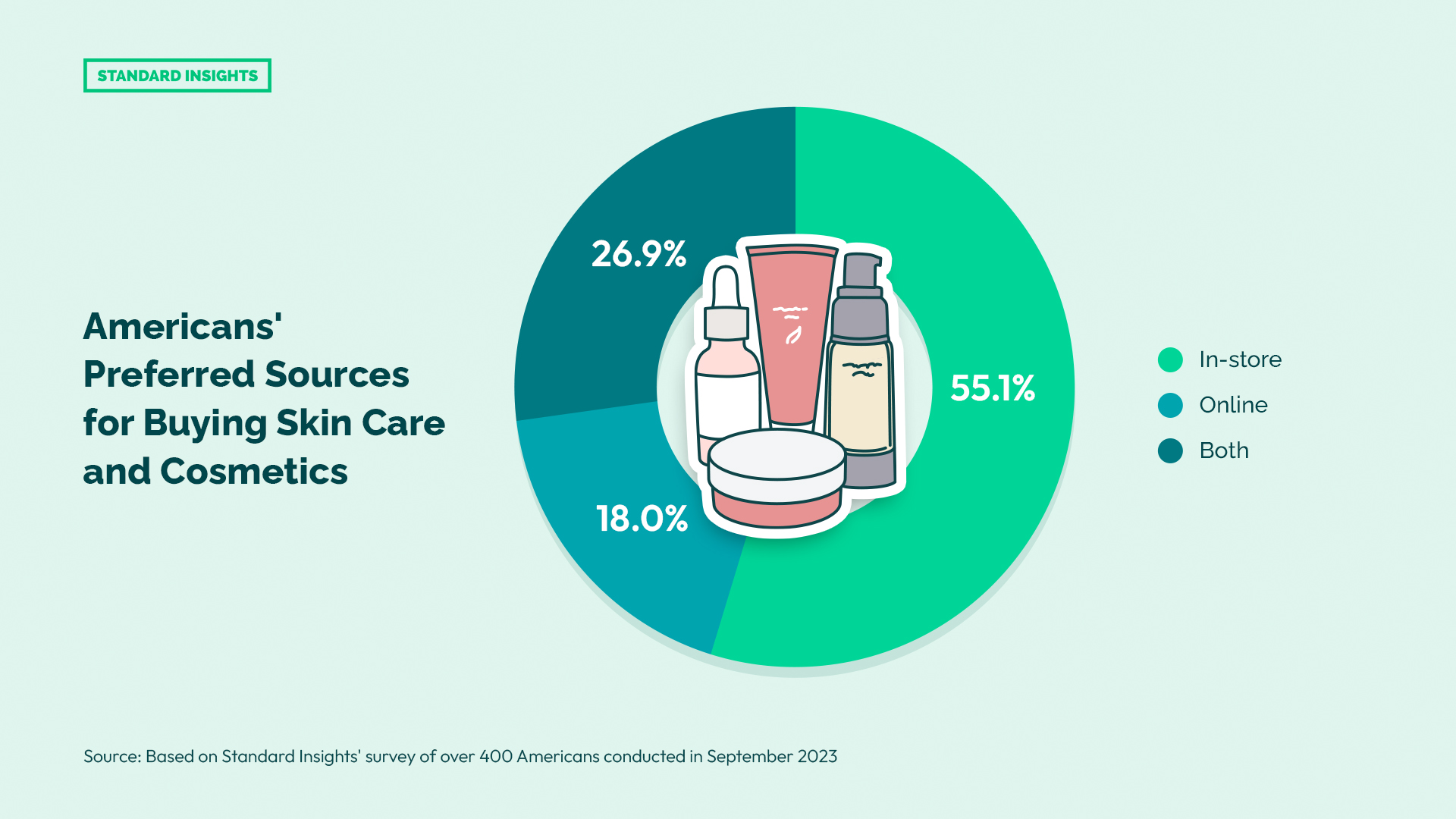

While e-commerce is booming, the survey showed that 55% of Americans still prefer to buy their cosmetics and skincare in physical stores. This doesn’t mean businesses should choose one channel over the other.

A separate study by IBM said that “consumers no longer see online and offline shopping as distinct experiences—they expect everything to be connected all the time” and also noted that shopping must be “fast and efficient,” and other times, it should be “rich and experiential.”

When it comes to choosing skincare and cosmetic products, six out of 10 Americans are primarily seeking quality and affordability, according to the survey results.

The significance of ingredients cannot be overlooked either, with 43.9% of respondents ranking it as a crucial factor in their decision-making process. This underscores the growing trend of consumers prioritizing products with natural and beneficial ingredients.

In skincare products, some of the most sought-after ingredients, according to Vogue Business, are polypeptide, snail mucin, seaweed, polyglutamic acid, copper peptide

While brand reputation still carries weight in US skincare and cosmetics preference, it ranks lower among the factors influencing purchases, at 33%. Celebrity endorsements, on the other hand, play a minor role, with only 3.6% of respondents swayed by star endorsements.

Recommendations from friends and family appear to carry substantial weight in purchase decisions, as 13.7% of respondents value these personal endorsements.

Consumers’ willingness to explore new products and trends is a goldmine for brands and innovators. Standard Insights report showed that at least 6 out of 10 Americans are willing to try out new skincare and cosmetic products.

A Confidence Boost and Self-Care Ritual

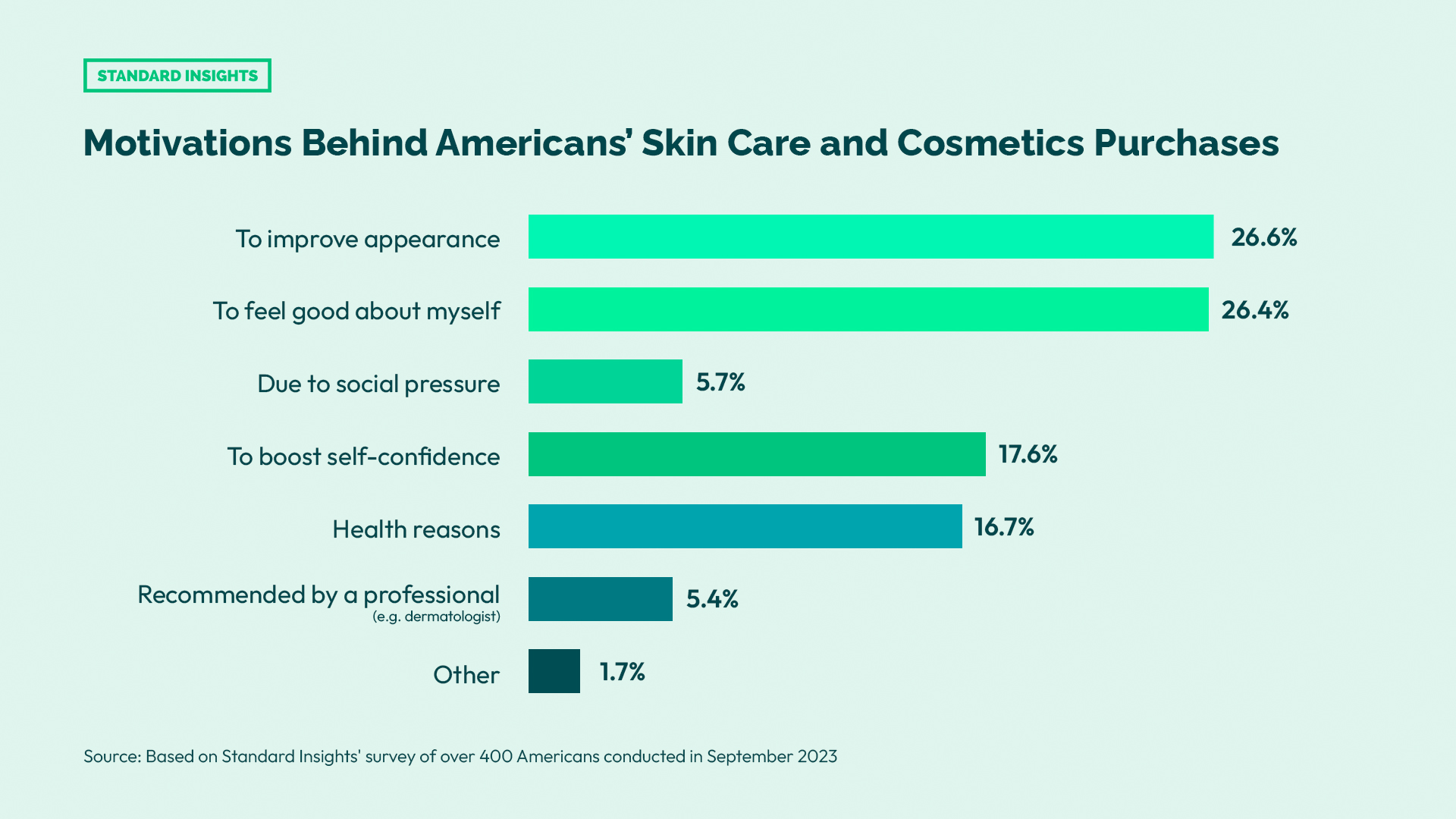

The findings show that beauty and confidence are the driving forces behind the purchase of skincare and cosmetics, with other factors also playing a significant role in consumers’ choices.

Over half of the respondents or 56%, cited the desire to improve their appearance as the primary reason for buying skincare and cosmetics.

Just a hair’s breadth behind, 55.6% of participants noted that they purchased these products to feel better about themselves.

Meanwhile, 37% of respondents indicated that they buy skincare and cosmetics to boost their self-confidence. This figure highlights the transformative power of beauty products in fostering self-assurance.

Research by Harvard Medical School and the University of Chieti further validates these claims, revealing that cosmetics can enhance an individual’s self-esteem, attitude, and personality. It also draws a compelling link between makeup use and academic achievements.

Going Green: The Natural and Sustainable Trend

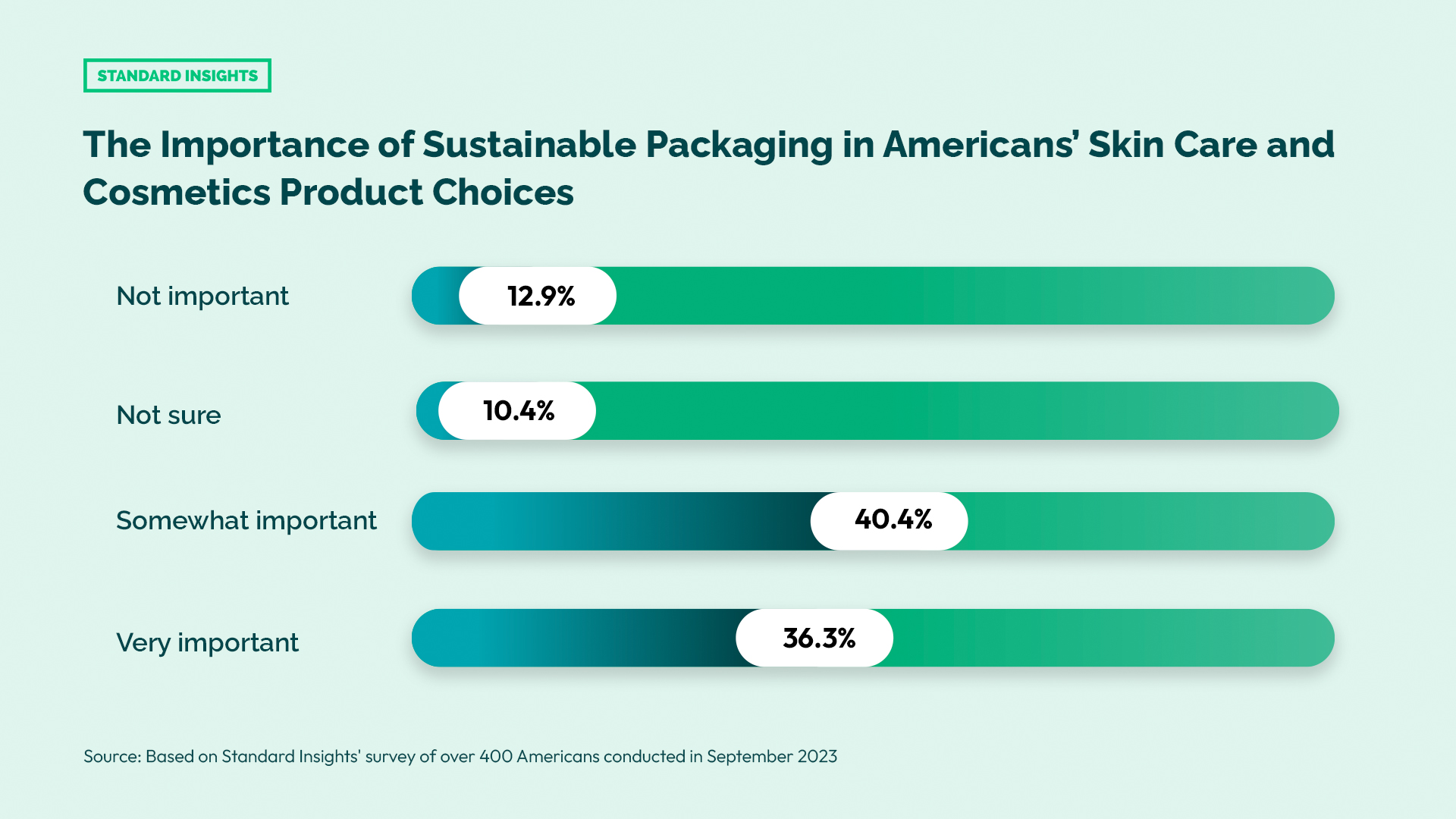

A wave of green and sustainable practices sweeps through the industry, with eco-conscious consumers valuing environmentally friendly packaging and organic products.

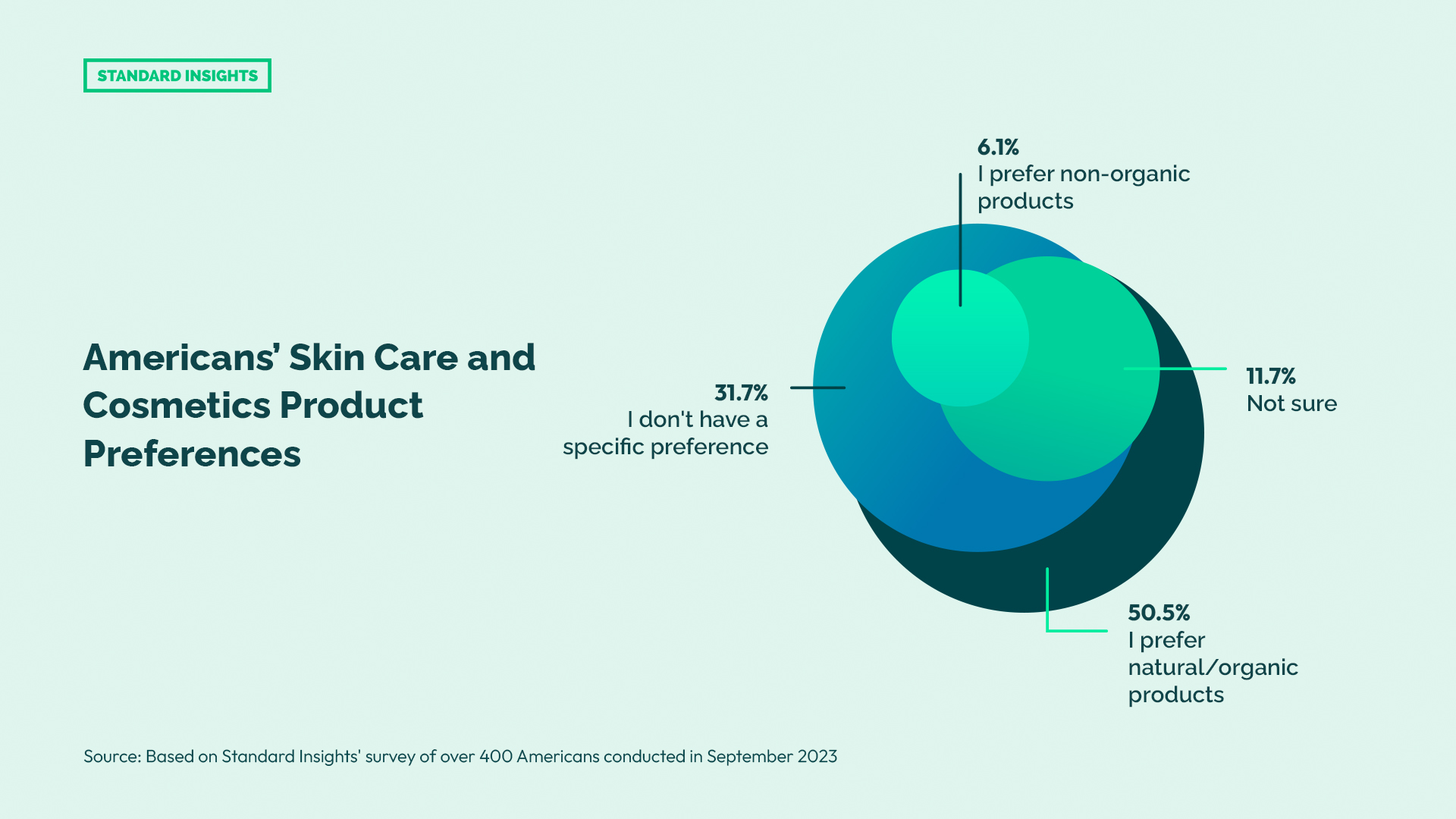

Standard Insights’ report showed that around 8 out of 10 Americans recognize the value of sustainable packaging. Meanwhile, more than half of Americans prefer natural and organic products.

Annually, the cosmetic industry contributes a staggering 120 billion units of plastic packaging from bottles, tubes, and containers and 70% of these end up in landfills.

According to a study carried out by PBS NewsHour and Marist Poll, 24% of the American population is willing to spend an additional 5% of their budget towards environmentally-friendly products.

Given the demand for sustainable products, some companies have started to offer refillable beauty products such as Glossier’s eye shadow, Kiehl’s Creme de Corps, and Victoria Beckham Beauty Matte Bronzing Brick.

Power of social media

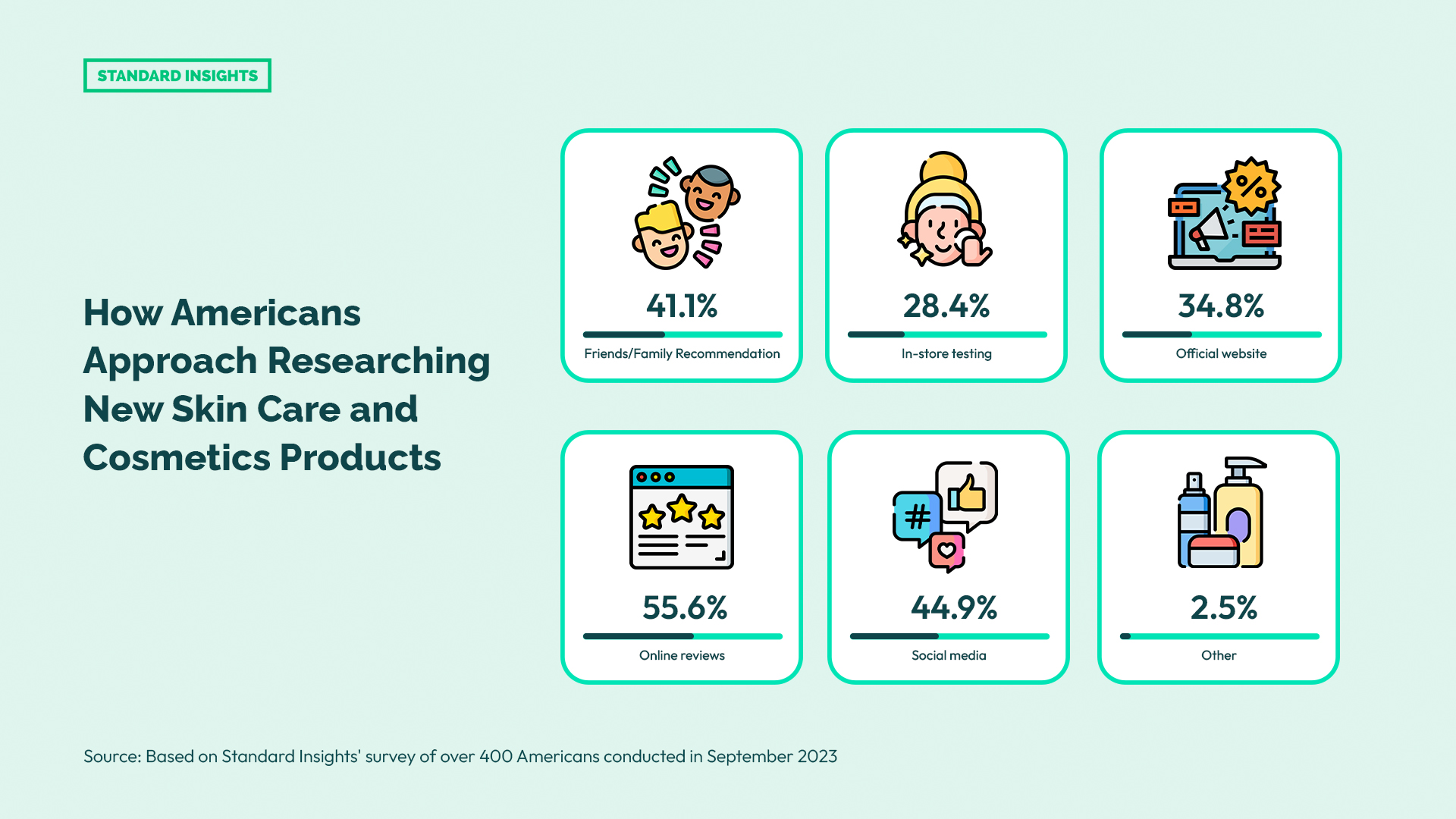

In the quest for new skincare and cosmetics, 55.6% of respondents turn to online reviews, while 44.9% rely on social media platforms such as TikTok and YouTube. Additionally, 34.8% visit official brand websites, 28.4% engage in in-store testing, 41.1% seek recommendations from friends and family, and a small percentage, 2.5%, employ alternative methods.

A survey showed that 89% of TikTok users have purchased beauty products after seeing them on the app. The opportunity to grow business in this short-form video platform is also increasing as it recently launched an in-app shopping experience in the United States.

Conclusion

The US skincare and cosmetics industry is a thriving market, with consumers spending billions of dollars each year on products to improve their appearance, boost their confidence, and engage in self-care rituals.

Consumers are increasingly prioritizing quality, affordability, and natural ingredients when choosing skincare and cosmetic products. They are also more willing to try new products and trends, which presents a unique opportunity for brands and innovators.

The growing demand for sustainable products is another key trend in the industry. Consumers are increasingly aware of the environmental impact of the beauty industry and are looking for products with eco-friendly packaging and organic ingredients.

Social media plays a significant role in influencing consumers’ purchase decisions. Consumers turn to online reviews, social media platforms, and brand websites to research new products before making a purchase.

These insights are crucial for brands and marketers aiming to develop and promote successful products in the US skincare and cosmetics market.