Retail banking in Hong Kong has undergone significant transformations in recent years, driven by technological advancements and changing consumer preferences. As digitalization continues to reshape the banking landscape, traditional banking institutions are faced with the challenge of adapting to meet the evolving needs of their customers.

In 2023, we surveyed over 1,000 Hong Kong residents for our Consumer Report Hong Kong 2023. Among the topics we explored were the banking preferences and attitudes of Hong Kongers. Below, you will find some of the highlights of the results of the survey, accompanied by our short analysis of key trends and innovations shaping retail banking in Hong Kong, and how you can leverage these changes to enhance your banking experience.

Overview of Retail Banking in Hong Kong

Hong Kong stands as a prominent global financial hub, boasting a cohesive network of institutions and markets that cater to a diverse array of local and international customers and investors. Undoubtedly, the financial services sector remains a crucial economic pillar, contributing 21.3% to the city’s GDP.

As of May 2020, the sector of banking in Hong Kong consisted of 163 licensed banks, 17 restricted license banks, and 13 deposit-taking companies. Additionally, 42 local representative offices of overseas banking institutions bolstered the sector’s strength. These institutions hail from 34 different economies and encompass 78 of the top 100 global banks. Collectively, they operate an extensive network of approximately 1,245 local branches, excluding their primary place of business in Hong Kong.

Throughout 2021, the sector of banking in Hong Kong displayed remarkable resilience as the global economy gradually rebounded from the previous year’s recession. With sustained policy support and an improved pandemic situation worldwide, the global economy experienced positive growth. In line with this favourable backdrop, Hong Kong’s economy expanded by an impressive 6.4% compared to the contraction of 6.1% in 2020. Notably, banking in Hong Kong played a significant role in driving this growth, witnessing an increase in its overall balance sheet. Deposits surged, and the total assets of licensed banks expanded by 4.9%, reaching HK$24 trillion. Furthermore, there was a 6.6% growth in loans and advances, solidifying the sector’s upward trajectory.

Digital Transformation in Retail Banking in Hong Kong

With its impressive internet speeds, ranked among the best in the world, and a remarkable internet penetration rate of 93.1%, Hong Kong is currently undergoing a rapid digital transformation in its banking sector. The rise of digital banking platforms has revolutionized how customers conduct their financial activities, providing them with convenient and secure online channels. Traditional banks have made substantial investments in robust digital infrastructures, offering services such as online banking, mobile banking, and web-based applications. This shift towards digital platforms has significantly enhanced accessibility, ensuring round-the-clock availability and streamlining banking processes for greater efficiency.

Furthermore, the widespread use of smartphones has paved the way for the expansion of services for mobile banking in Hong Kong. In the early months of 2023 alone, there were a staggering 16.75 million active cellular mobile connections, equivalent to a remarkable 223.7% of the total population. Banking institutions have responded to this trend by developing feature-rich mobile applications that offer customers a comprehensive suite of services, ranging from fund transfers and bill payments to account management. The convenience and user-friendly nature of these mobile banking apps have made them the preferred choice for many consumers, contributing to the rapid growth of digital banking in Hong Kong.

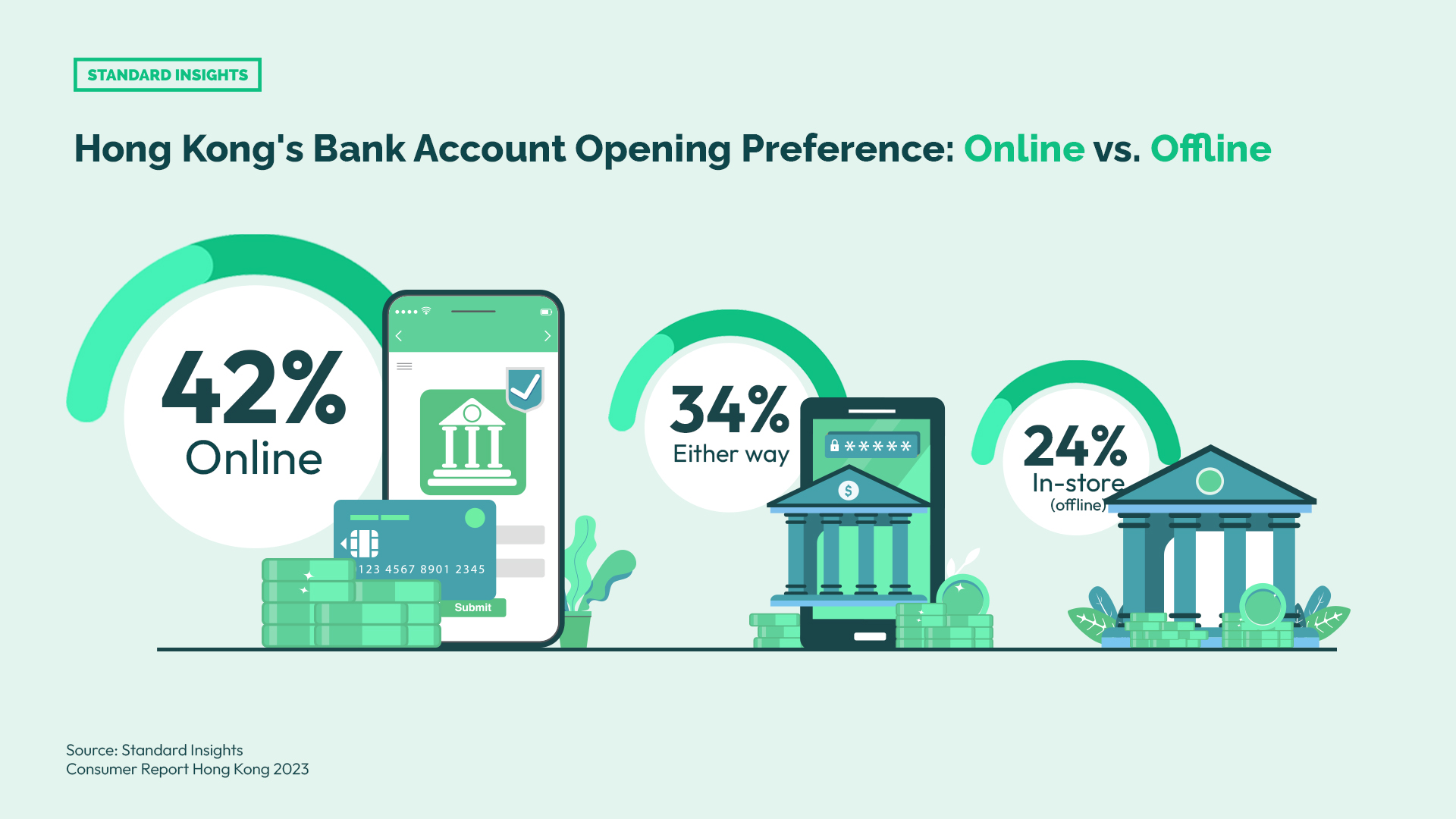

By regularly conducting market research in Hong Kong, we have found that a significant majority of 42.0% prefer to open a new bank account online rather than visit a physical branch. “Opening a bank account online is an absolute must for our generation. In this era of constant connectivity and smartphones glued to our hands, the traditional way of going to the bank feels outdated and time-consuming, and it’s encouraging to see that banks in Hong Kong have integrated this shift,” says Djon Ly, Digital Marketing Manager of Fintech firm Statrys, emphasizing the necessity of embracing digital channels in banking.

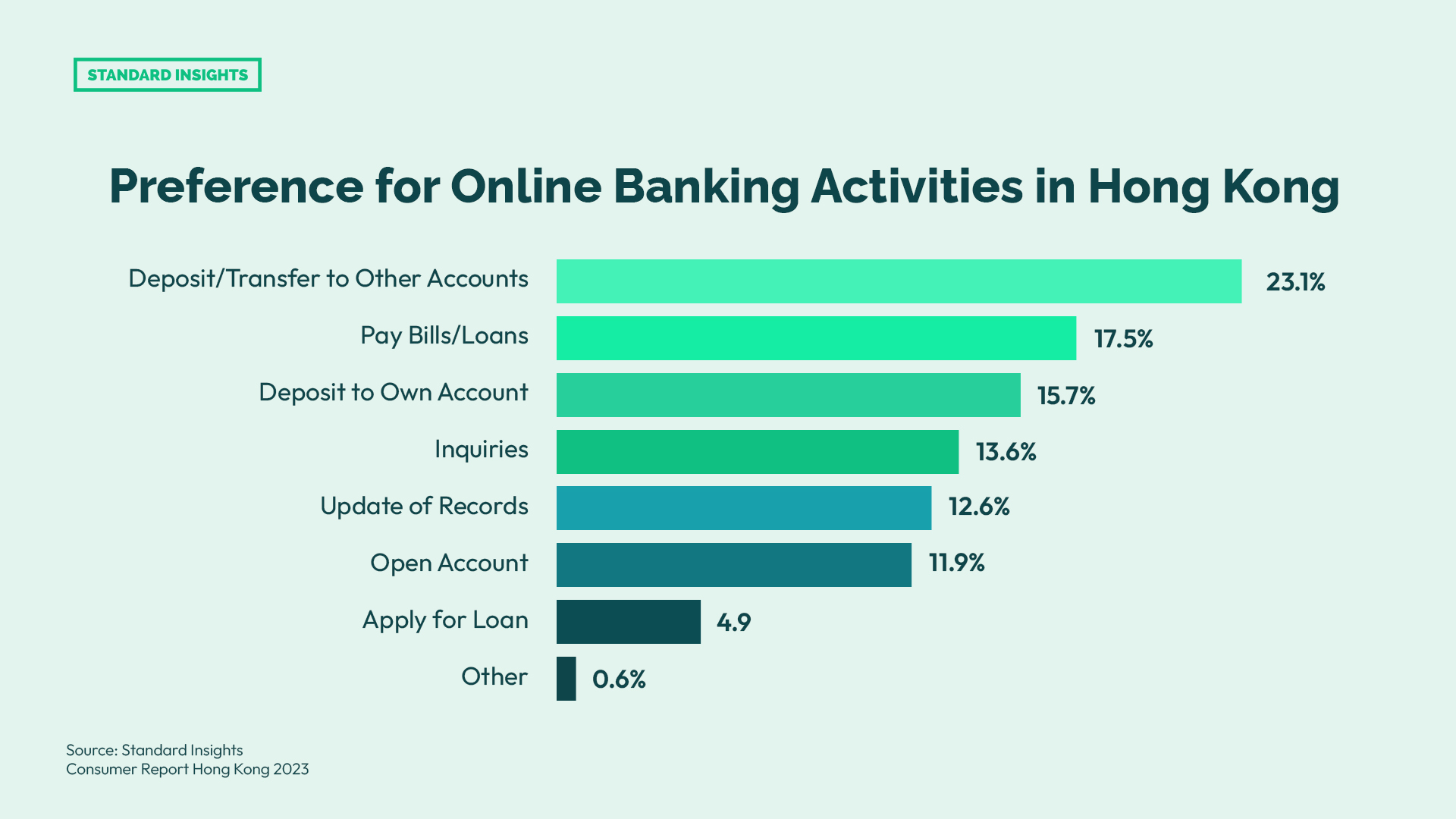

When it comes to specific banking activities, the survey highlights that a substantial number of respondents prefer to perform tasks such as depositing/transferring to other accounts (23.1%) and paying bills/loans (17.5%) online. Depositing to one’s account (15.7%) and making inquiries (13.6%) are also popular choices for online banking in Hong Kong.

Fintech Disruption in Hong Kong

Hong Kong is experiencing a remarkable wave of fintech disruption, fueled by its thriving ecosystem. The city is home to more than 600 fintech companies and 3,700 startups, including over 10 unicorn companies. Notably, Hong Kong boasts one of the highest fintech adoption rates in the world at 67%, surpassing countries like France, the United States, and Japan. In fact, it ranks among the top 5 developed markets globally for consumer fintech adoption. Recognizing the potential of fintech, the Hong Kong government is actively promoting the city as a financial centre, with fintech as a key subsector. To further drive fintech development, the Hong Kong Monetary Authority (HKMA) introduced the “Fintech 2025” strategy in June 2021, aiming to facilitate comprehensive technology adoption across the financial sector by 2025.

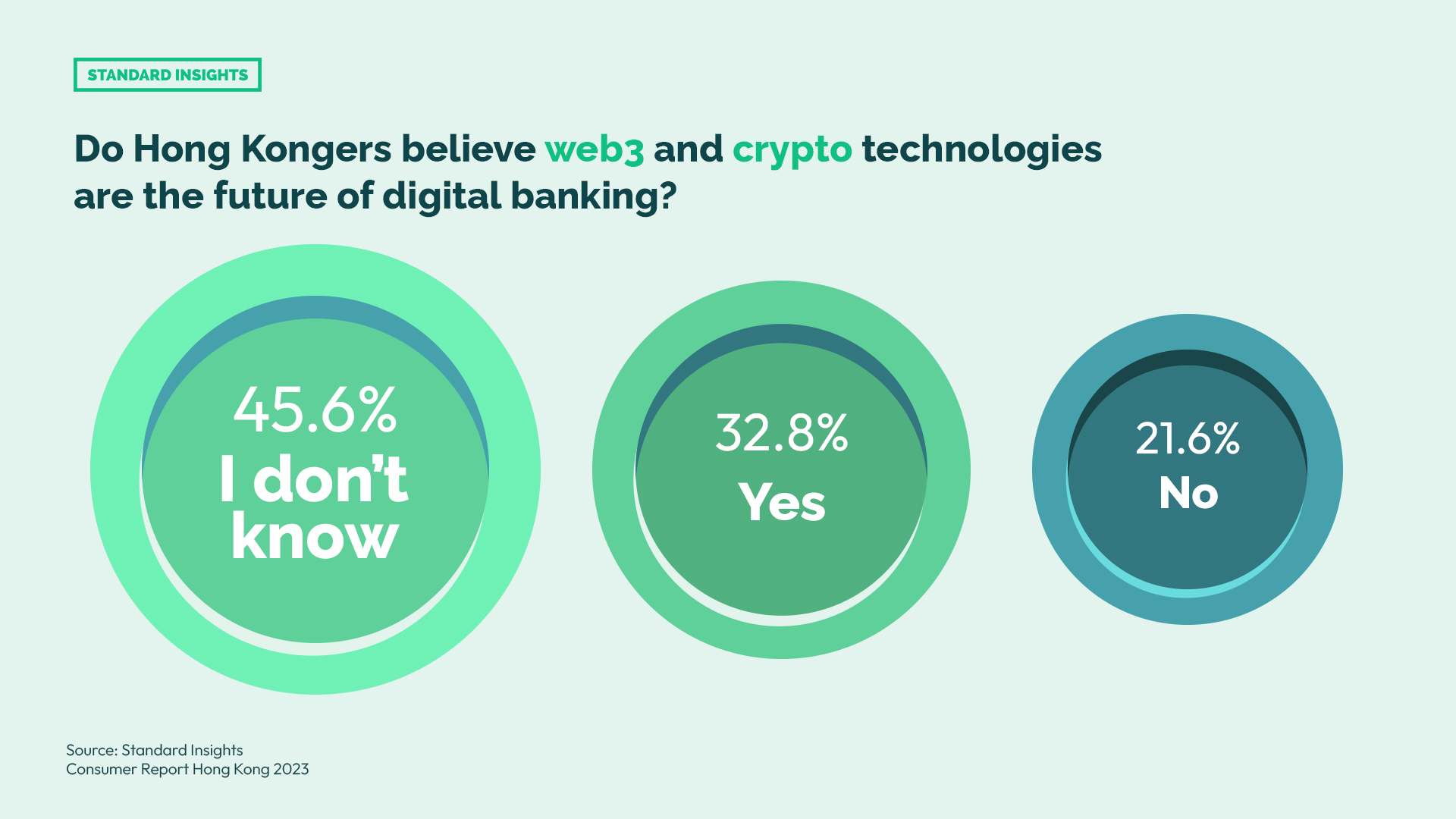

According to our report, when asked about their views on the future of digital banking in Hong Kong, approximately 45.6% of the respondents expressed uncertainty or lack of knowledge regarding the role of Fintech technologies like Web3 and cryptocurrencies. On the other hand, 32.8% of the respondents believed that these emerging technologies would indeed shape the future of digital banking in Hong Kong.

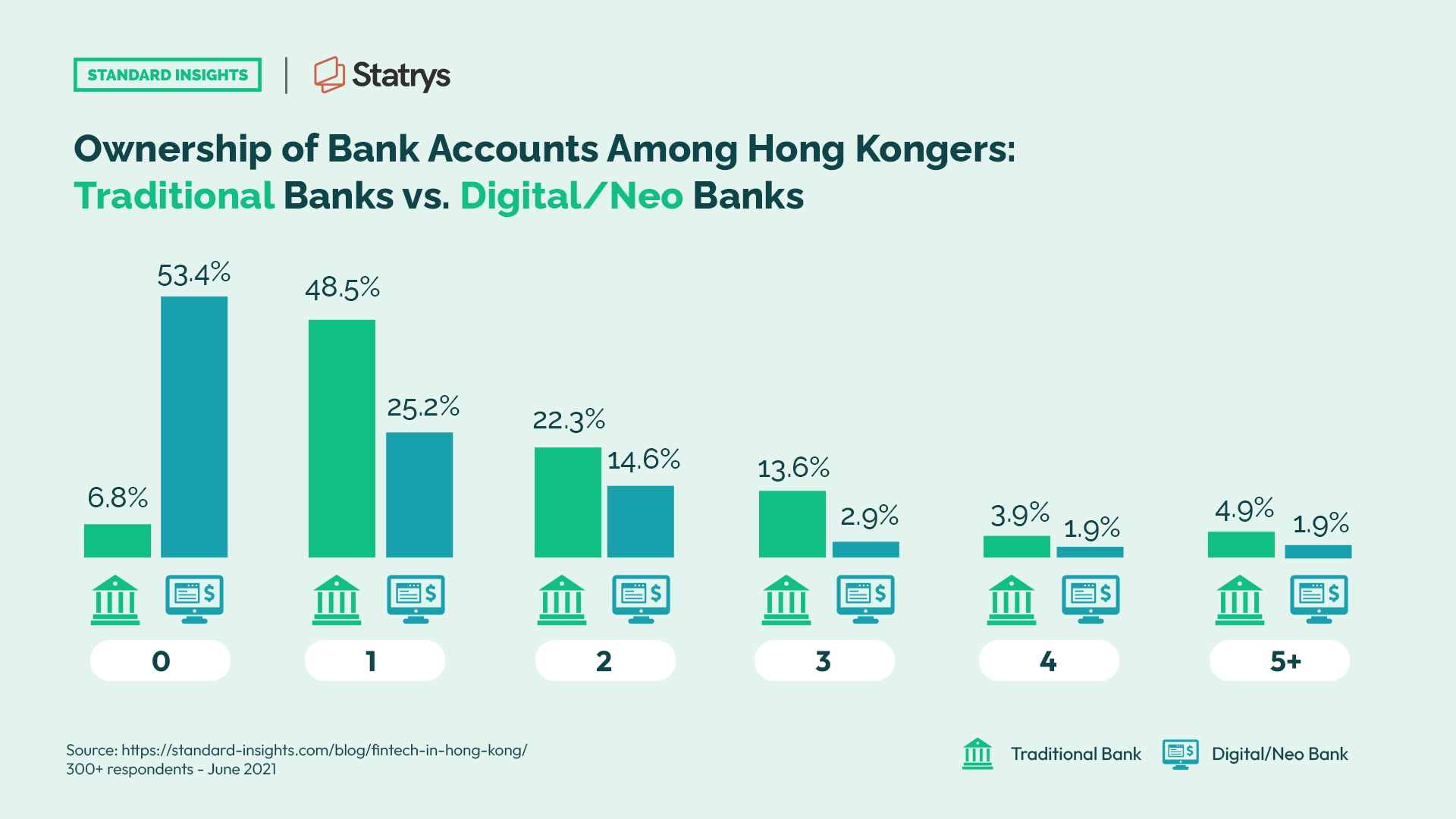

In 2021, we partnered with the Fintech company Statrys for a study in Hong Kong. We surveyed more than 300 professionals to understand their perceptions, behaviours, and preferences related to the professional banking segment and the Fintech sector in the city. The report’s findings revealed that close to half of Hong Kong residents (46.5%) own and actively use at least one digital or neo-bank for personal usage.

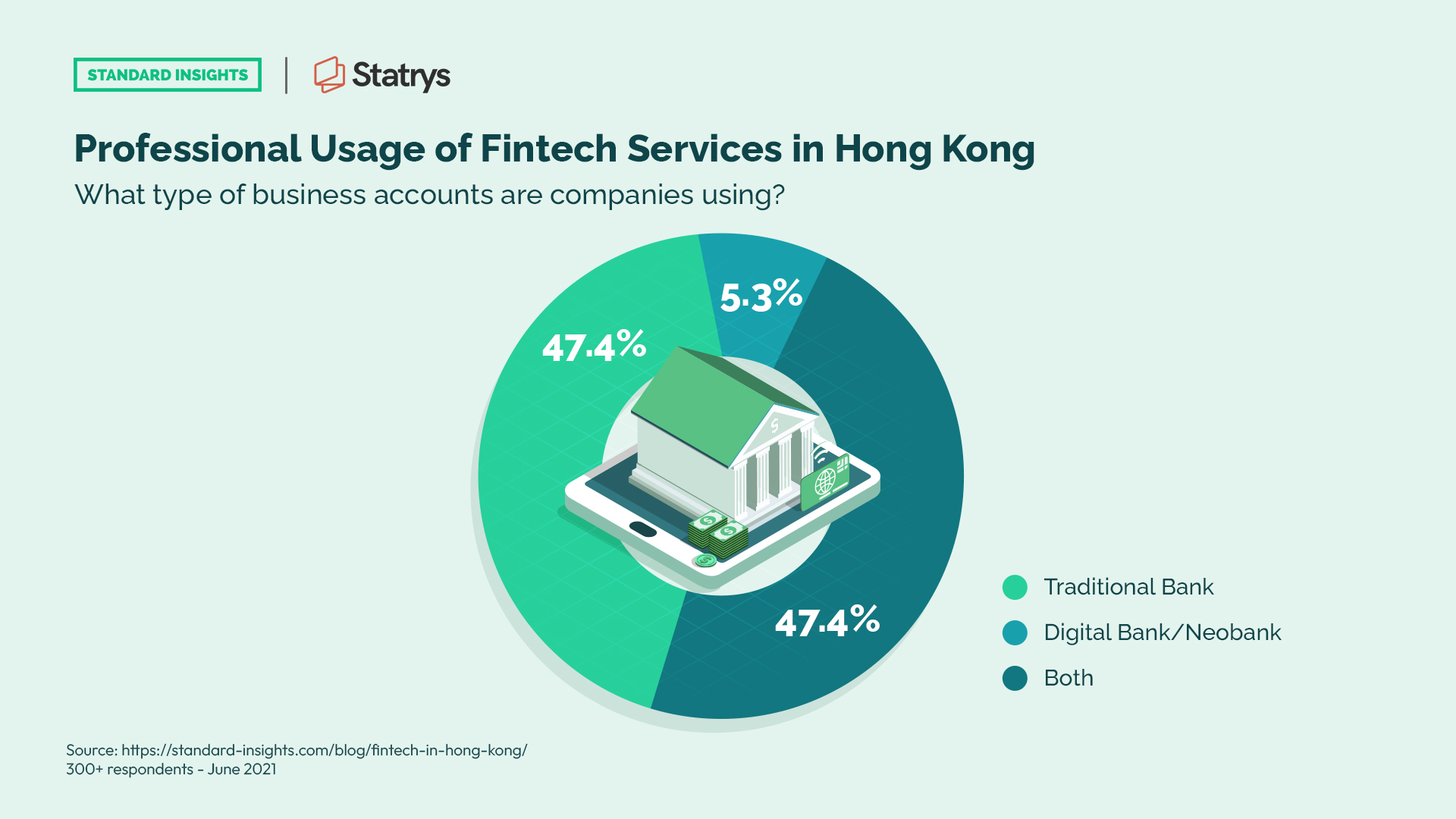

Meanwhile, when asked about how they utilize Fintech services for their work and the kind of business accounts their companies employ, over half of the respondents (52.7%) shared that their companies have embraced and are actively utilizing digital banks or neobanks. Specifically, 47.4% of those surveyed revealed that their companies make use of a blend of traditional banks and digital banks/neobanks, while 5.3% affirmed that their companies exclusively rely on digital banks/neobanks. This underscores the growing significance of digital banking trends in modern business practices.

Addressing Cybersecurity Risks

With the growing digitalization of banking services, cybersecurity has become a top priority for retail banks in Hong Kong. The increasing prevalence of cyber threats, data breaches, and identity theft requires banks to invest in robust cybersecurity measures to protect customer data, financial transactions, and digital infrastructure. Safeguarding customer trust and maintaining the integrity of the banking system is critical for the continued growth and success of retail banks.

Addressing this critical need, the Hong Kong Monetary Authority (HKMA) took proactive steps in 2020 by launching the Cybersecurity Fortification Initiative 2.0. This upgrade builds upon the original version introduced in 2016, aiming to enhance the cyber resilience of Hong Kong’s banking system. The initiative also focuses on streamlining the cyber resilience assessment process, ensuring that control standards align with the latest technology trends. By implementing robust security measures such as multi-factor authentication, encryption technologies, and real-time monitoring systems, banks can effectively safeguard against cyber threats. These measures play a pivotal role in securely transmitting and storing customer data while effectively mitigating unauthorized access attempts.

To Wrap up

In conclusion, retail banking in Hong Kong is undergoing significant changes driven by digitalization and evolving customer preferences. Traditional banks are embracing digital platforms, offering online and mobile banking services for greater accessibility. Fintech disruption is on the rise, with a thriving ecosystem of fintech companies in Hong Kong. However, there is still uncertainty regarding the role of emerging technologies like web3 and cryptocurrencies in the future of digital banking. Cybersecurity has become a top priority, with initiatives in place to protect customer data and ensure the integrity of the banking system. As the industry continues to evolve, banks in Hong Kong must adapt to these changes, collaborate with fintech partners, and prioritize cybersecurity to meet the needs of customers in the digital era.

Want to learn more? Beyond retail banking, Hong Kong boasts a vibrant landscape across various sectors and industries. Book a demo with us and get exclusive insights on various topics from eCommerce to tourism. Our detailed report will help you understand the latest trends and changes in Hong Kong. Don’t miss out; join us to explore Hong Kong’s diverse landscape.