The rise of fintech in Hong Kong has had a remarkable impact on the Banking Industry in the country. How did Hong Kongers react to this trend? Which factors should banks focus on when adopting digital transformation?

Introduction

Hong Kong is renowned for its technological advancement. The penetration of internet access and mobile phone usage is intensively bolstered, making it a viable platform for Hong Kong’s fintech ecosystem.

Invest Hong Kong’s report shows that Hong Kong is home to approximately 600 fintech enterprises and startups. Furthermore, 86% of local banks have incorporated or plan to incorporate fintech solutions through all financial services.

The city was ranked fifth among developed markets for consumer fintech adoption. Since 2014, Hong Kong fintech businesses have raised over 1.1 billion USD in venture capital.

The Hong Kong government plans to enhance Hong Kong’s presence as a financial hub, with fintech as a primary subsector to invest in. Specifically, the Hong Kong Monetary Authority (HKMA) has identified 7 Smart Banking Initiatives:

- Research and Talent Development

- Faster Payment System

- Fintech Supervisory Sandbox

- Virtual Banking

- Banking Made Easy

- Open API

- Closer cross-border collaboration

Will the Hong Kong government’s attempts be compensated? Will citizens of the country favorably select proposed fintech banking solutions for their daily usage? This article analyzes Hong Kongers’ banking preferences based on a Standard Insights survey of 300 professionals on banking services and FinTech in Hong Kong. FinTech company Statrys teamed up with Standard Insights to design the survey for this research.

Let’s scroll down for more details!

Traditional Banks Have Room For Digital Transformation

According to our digital survey, 45.6% of respondents have used more contactless payment methods since the Covid-19 outbreak. Meanwhile, 53.4% of Hong Kongers selected contactless payment solutions for their banking usage before the pandemic.

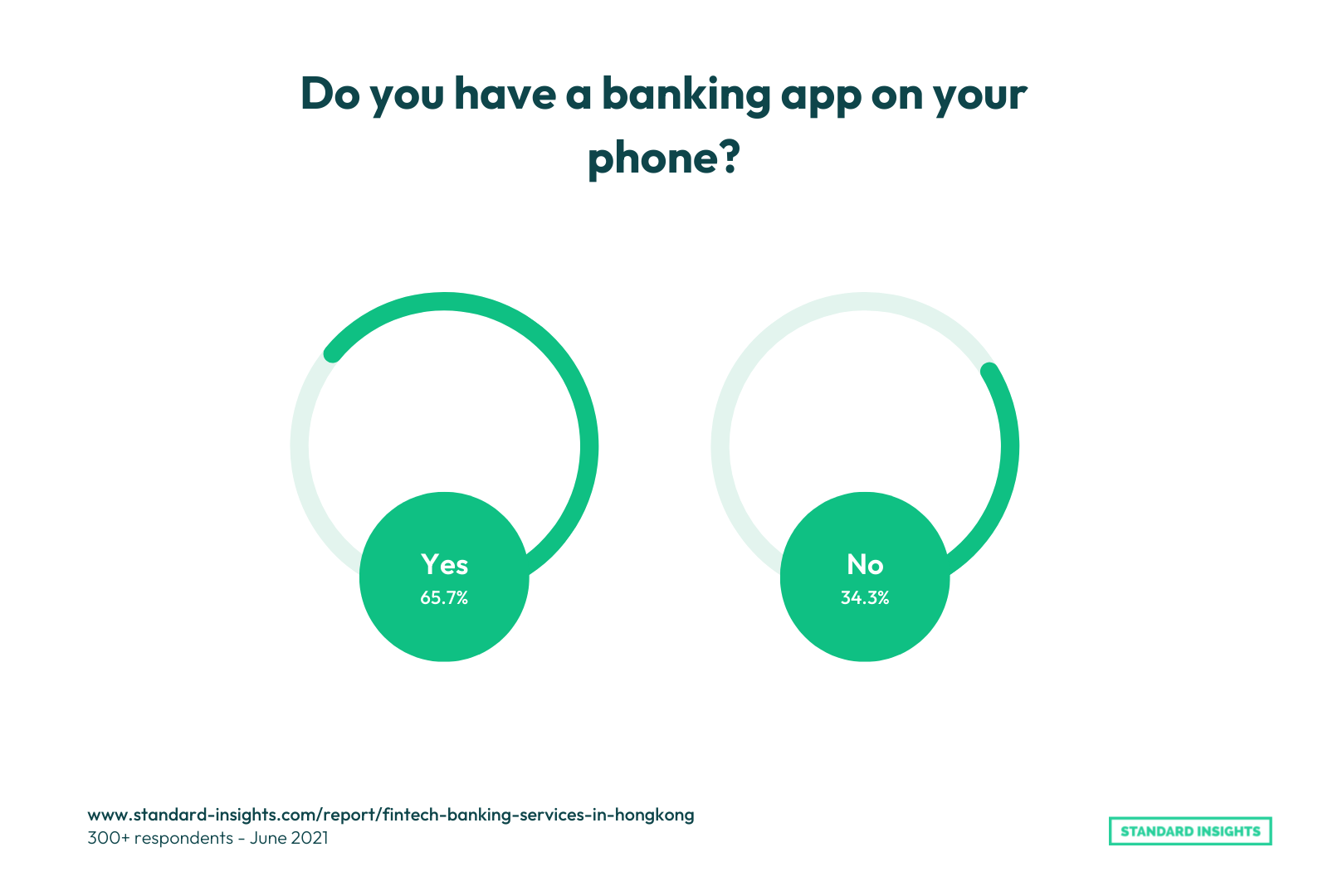

Indeed, 65.7% of Hong Kongers confirm installing a banking app on their phone. Also, 42.1% make professional payments online with high-frequency banking: weekly and monthly.

We anticipate that these trends in banking behavior will change the way people utilize bank branches. Customers who enjoy speedier onboarding and more efficient customer service on digital channels are less prone to return to the enormous queues that are commonly correlated with physical outlets.

Factors Affecting The Adoption of Digital Banking in Hong Kong

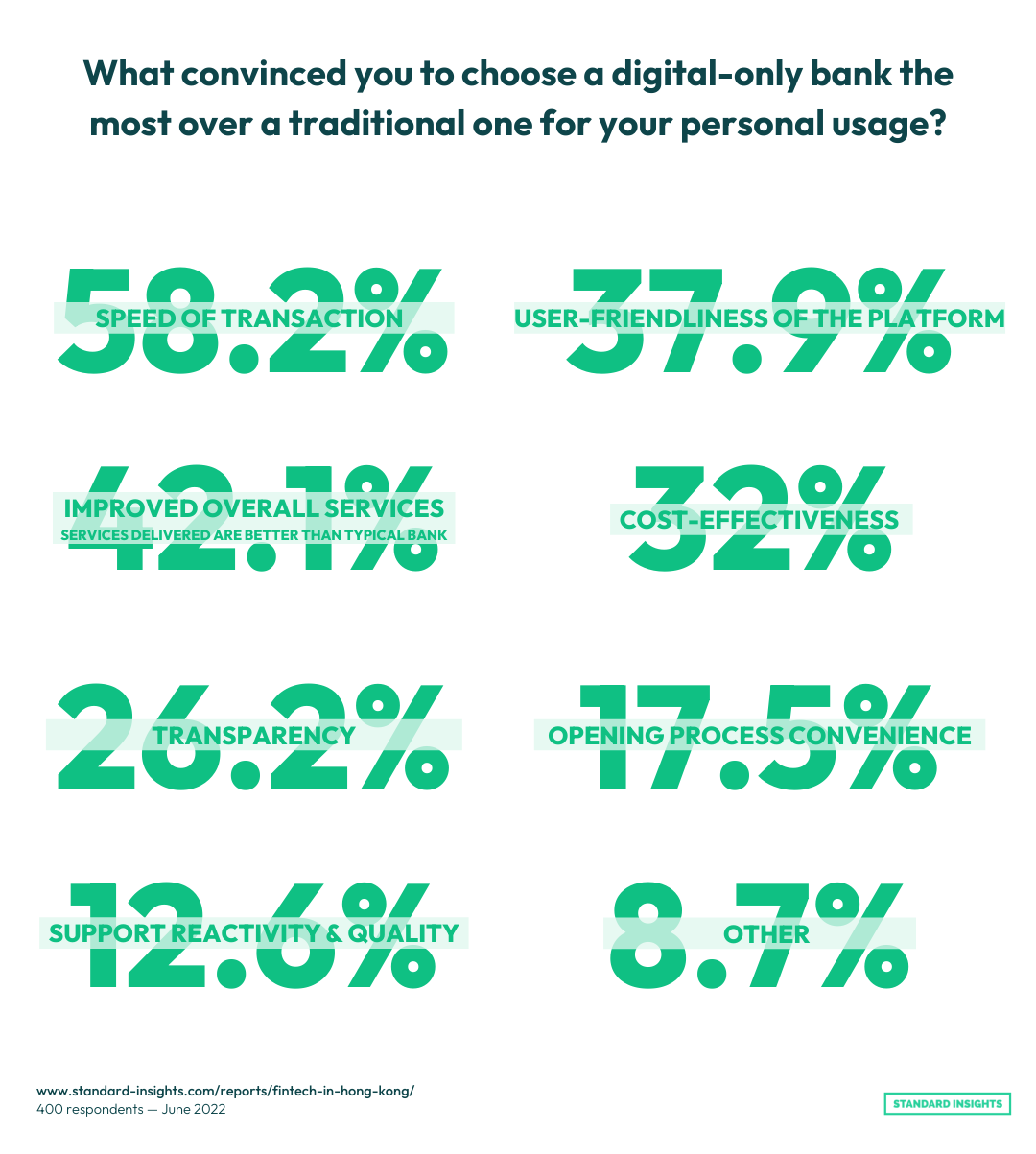

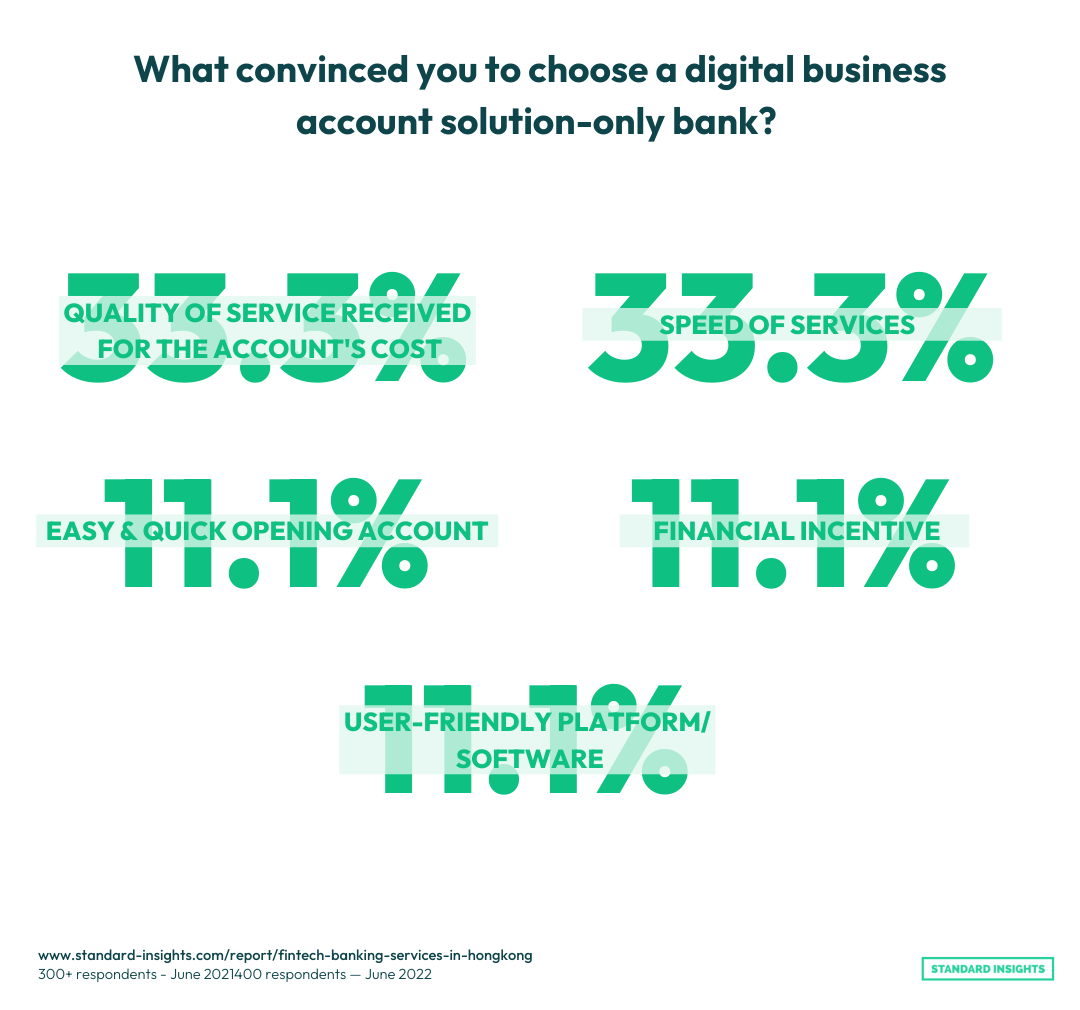

According to our survey, the following factors convince them to choose a digital-only bank over a traditional counterpart for their usage:

- The speed of transactions

- The quality of services received for the account’s cost

- The platform’s user-friendliness

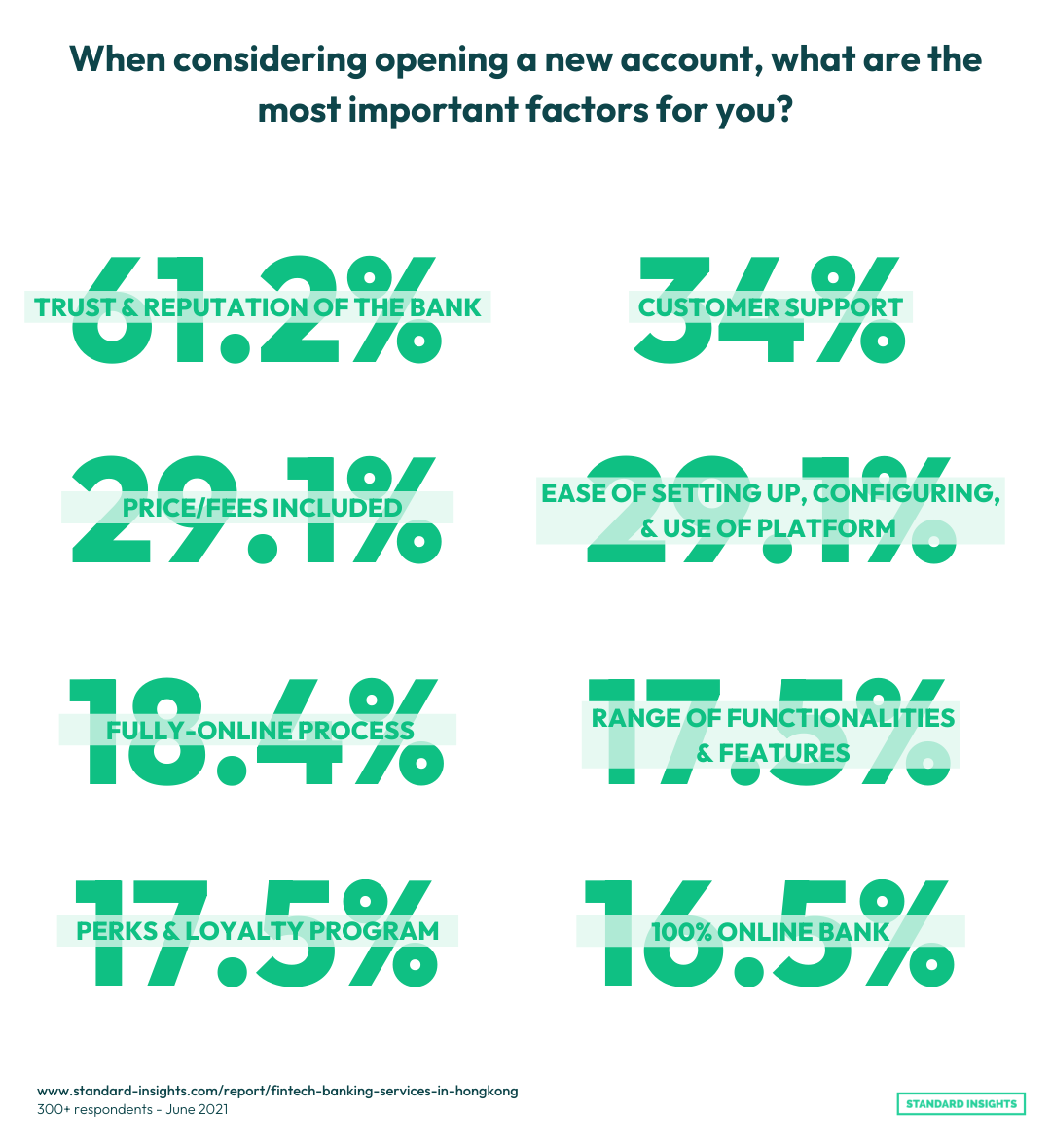

Based on our survey, the trust and reputation of the bank is the most crucial factor when considering opening a bank account. Therefore, bank branches should figure out strategies that help leverage the bank’s awareness and trustworthiness besides the user experience features mentioned above.

Wrap Up

In recent years, the Hong Kong banking industry has been at the forefront of fintech growth, offering a wide range of services and products to consumers via digital channels. As an example, the use of the Faster Payment System (FPS) has increased significantly.

The HKMA has been creating a favourable policy framework that allows the sector to take advantage of possibilities systematically created by fast technological advancements. In areas such as consumer protection and cyber security, the HKMA will continue to strive for the highest international standards.

The future of fintech in Hong Kong seems brighter than ever. Do you agree?

Want to learn more about Hong Kongers’ perspectives on FinTech in Hong Kong, as well as other topics? Uncover their true thoughts and emotions with our targeted Market Research in Hong Kong. Empower confident, data-driven decisions and unlock success in the Hong Kong market.