In recent years, the landscape of commerce in Thailand has undergone a remarkable transformation. With a rapidly growing population of internet users and a burgeoning middle class, the country has embraced the digital revolution with open arms, propelling the rise of eCommerce to new heights. The online marketplace in Thailand has become a vibrant and dynamic ecosystem, attracting both local entrepreneurs and international giants eager to tap into this promising market.

To gain a deeper understanding of the growing eCommerce in Thailand, Standard Insights conducted a comprehensive survey targeting the local population. The objective was to gauge their sentiments and viewpoints on online shopping. Below, you will find the results of the survey, accompanied by our insightful analysis.

How big is the eCommerce market in Thailand?

Thailand, the second-largest economy in Southeast Asia, has made impressive strides in its Internet economy, encompassing various sectors such as eCommerce, Transport and Food, Online Travel, and Online Media. With a market value of USD 35 billion in 2022, the country has firmly established itself as a formidable player in the region. Moreover, it is projected that Thailand’s Internet economy will continue its upward trajectory, reaching a remarkable value of USD 53 billion by 2025.

The driving force behind this growth is primarily eCommerce, which is projected to generate a revenue of USD 20.90 billion in 2023. Furthermore, eCommerce in Thailand is expected to exhibit a robust annual growth rate of 11.93% from 2023 to 2027, leading to a projected market volume of US$32.81 billion by 2027.

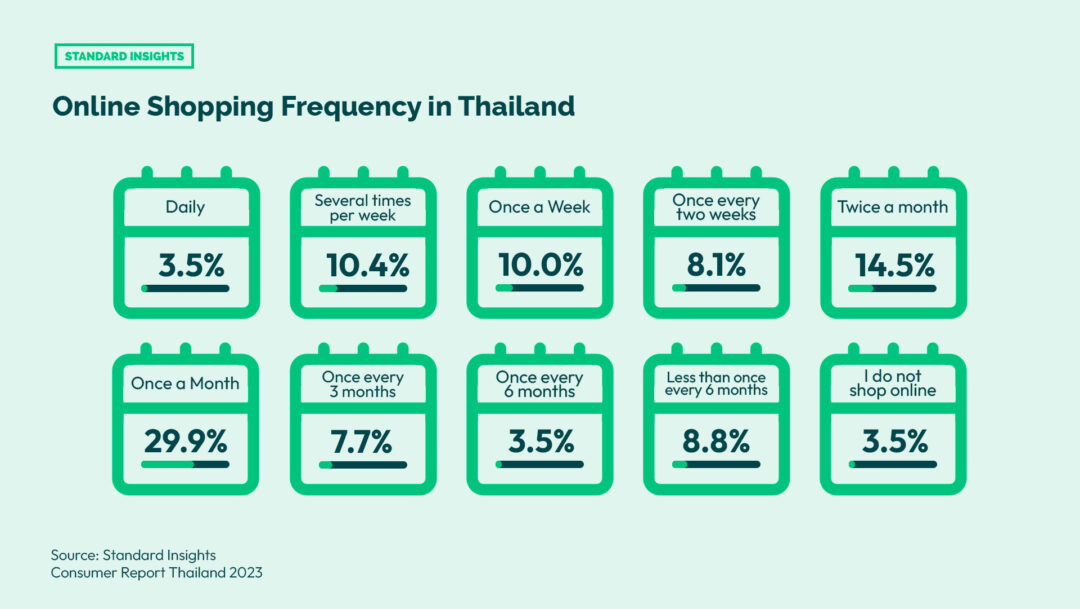

Standard Insights’ latest Consumer Report Thailand 2023, which surveyed over 1,000 Thai respondents, highlights the country’s escalating preference for online shopping. According to the report, a significant majority of 76.4% of Thai respondents shop online at least once a month. Only a marginal 3.5% of respondents declared that they do not engage in online shopping.

Furthermore, in terms of preferred product categories for online shopping among Thai consumers, fashion items such as clothes and footwear take the lead, with an impressive 60.12% of respondents favouring this category. Beauty and personal care products also garnered significant attention, ranking second with 43.42% of respondents selecting this category. Interestingly, this trend holds across all demographics except for males and Thais aged 35 and above, who expressed a greater preference for consumer electronics as their second most favoured product category.

The Rise of eCommerce Market in Thailand: Factors to its Growth

eCommerce in Thailand has witnessed unprecedented growth, fueled by factors such as increased internet penetration, widespread smartphone adoption, and a shift in consumer behaviour towards online shopping. The convenience and accessibility of online platforms have revolutionized the way people in Thailand engage in commerce, enabling them to browse, compare, and purchase products and services with just a few clicks. Below, we explore four key factors contributing to the remarkable growth of Thailand’s eCommerce sector:

1. Increased Internet Penetration

The rapid expansion of internet accessibility has been a driving force behind the remarkable growth of eCommerce in Thailand. This increased accessibility has opened the doors for a larger population to participate in online shopping, contributing to the flourishing eCommerce market. As of the beginning of 2023, Thailand boasted 61.21 million internet users, with an impressive internet penetration rate of 85.3%. These figures demonstrate the widespread adoption and utilization of the Internet by the Thai population, highlighting the significant role it plays in driving the success of eCommerce in the country.

Indeed, the same Standard Insights report further highlights this trend by revealing that a significant 57.76% of Thai consumers consider website reviews to be the most influential source of information when making online purchase decisions. Additionally, social media platforms like Facebook, Instagram, and TikTok have also emerged as potent sources of information, impacting the online buying decisions of 49.12% of Thai respondents.

2. Widespread Smartphone Adoption

The widespread adoption of smartphones has revolutionized the way people engage with online platforms. This surge in smartphone usage has been particularly notable during the pandemic, and this trend has persisted globally. Projections indicate that the number of smartphone users in Southeast Asia was set to reach a remarkable 326.3 million by 2022, with a steady upward trajectory expected to reach 359.4 million by 2026. In Thailand, smartphone penetration among internet users in the region was forecasted to boast an impressive rate of 98.8%.

With smartphones becoming more affordable and accessible, a significant portion of the Thai population now has the means to browse and make purchases through eCommerce platforms conveniently.

3. Improved Logistics

The development and continual enhancement of logistics infrastructure in Thailand has played a pivotal role in bolstering the growth of eCommerce. With the establishment of efficient delivery networks, reliable shipping services, and advanced fulfilment capabilities, the process of product delivery has become notably faster and more dependable. These improvements have not only increased customer satisfaction but have also made online shopping an increasingly appealing choice for consumers. The seamless and reliable logistics framework has contributed to the overall success and attractiveness of the eCommerce landscape in Thailand.

4. Proliferation of e-Payment Systems

The availability of secure and convenient e-payment systems like digital wallets, credit and debit cards, QR code payments, and bank transfers, has been a significant enabler for the growth of eCommerce in Thailand. Traditionally, Thailand’s payment landscape has been heavily reliant on cash. As of 2017, a staggering 93% of daily transactions in the country were conducted using physical currency. However, recent events, such as the impact of the COVID-19 pandemic, have accelerated the uptake of digital payments. This surge in adoption is evidenced by the remarkable growth in the transaction value of digital commerce, which skyrocketed from approximately US$15 million in 2020 to an impressive US$26.6 million in 2021.

As various digital payment methods like TrueMoney, Rabbit: LINE Pay, AirPay, and PromptPay have emerged, consumers now can make online transactions easily and securely. This development has fostered trust and confidence in eCommerce transactions, further empowering the growth of online commerce in Thailand.

Major Challenges for Online Shopping in Thailand

While eCommerce in Thailand presents numerous opportunities for growth and convenience, it also comes with its fair share of potential risks and challenges. Businesses and consumers alike must be aware of these factors to navigate the eCommerce landscape effectively.

1. Security Concerns

One of the primary risks associated with eCommerce in Thailand is the potential for security breaches and fraud. Cybercriminals are constantly evolving their tactics to exploit vulnerabilities in online transactions, posing a threat to sensitive customer data and financial information. The report highlights several key challenges faced by Thai online shoppers, including a lack of trust in payment systems (39.3%), safety and security concerns (25.7%), the absence of comprehensive customer protection policies (16.31%), and the potential breach of personal data (5.50%).

To ensure the continued growth and success of eCommerce in Thailand, it is essential for eCommerce platforms and businesses to invest in and communicate robust security measures, such as encryption technology and secure payment gateways, to protect against these risks.

2. Trust and Consumer Confidence

Building trust and confidence among consumers is vital for the success of eCommerce in Thailand. Many consumers still prefer the traditional brick-and-mortar shopping experience due to concerns about product quality, authenticity, and after-sales support. The report further identifies deceptive advertising (38.9%), limited assurance of product quality (33.2%), and the availability of after-sale services (29.7%) as notable hurdles faced by Thai online shoppers.

To surmount these challenges, businesses can prioritize transparency by providing accurate product descriptions and images, offering dependable customer service, and establishing robust return and refund policies. By doing so, they can enhance consumer trust and address the concerns that impede the widespread adoption of eCommerce in Thailand.

3. Logistics and Delivery Challenges

A seamless eCommerce experience relies heavily on efficient logistics and dependable delivery networks. While Thailand has made notable strides in improving its overall logistics infrastructure, there is still room for growth, particularly in remote areas. The geographical diversity, as well as the traffic congestion in Thailand, pose challenges when it comes to ensuring timely deliveries, as highlighted in the report, where 24.4% of respondents identified delayed or slow delivery as a significant challenge.

To address this, businesses can forge partnerships with reliable logistics providers and leverage technology to optimize their supply chain management, tracking systems, and last-mile delivery solutions. These proactive measures are crucial in overcoming logistical hurdles and further enhancing the eCommerce experience for customers throughout Thailand, including those residing in remote areas.

Top E-Commerce Marketplaces in Thailand

Thailand’s vibrant eCommerce landscape is dominated by several top marketplaces that offer a wide range of products and services to online shoppers. Here are the top eCommerce marketplaces in Thailand:

- Lazada

Lazada is one of the largest and most popular eCommerce platforms in Thailand. It offers a vast selection of products, including electronics, fashion, home appliances, beauty products, and more. Lazada is known for its regular promotions, discounts, and reliable delivery services.

- Shopee

Shopee has gained significant traction in the Thai market and has become a major player in eCommerce. It provides a user-friendly interface, a wide variety of products, and competitive pricing. Shopee’s “Shopee Mall” feature offers trusted sellers and authentic products, adding to its appeal.

- Jib

Jib is a leading eCommerce marketplace specializing in electronics and IT products. It offers a comprehensive range of gadgets, computers, smartphones, gaming consoles, and accessories. Jib is well-regarded for its competitive pricing and reliable after-sales service.

- Power Buy

Power Buy is a popular destination for electronics and home appliances. It provides a wide selection of products, including televisions, refrigerators, air conditioners, kitchen appliances, and more. With a focus on quality brands and competitive prices, Power Buy caters to tech-savvy shoppers.

- JD Central

JD Central is an emerging player in the Thai eCommerce market. Backed by the renowned Chinese eCommerce giant JD.com, JD Central offers a diverse range of products, including electronics, fashion, beauty, home appliances, and groceries. It aims to provide a seamless shopping experience with reliable delivery services.

- Kaidee

Kaidee is a prominent online marketplace in Thailand, specializing in buying and selling second-hand products. It offers a platform for individuals and businesses to sell a variety of items, including electronics, vehicles, furniture, and more. Kaidee is known for its user-friendly interface and trusted community.

These top eCommerce marketplaces in Thailand provide consumers with a convenient and extensive shopping experience. Each platform offers its unique features, promotions, and strengths, catering to the diverse needs and preferences of Thai online shoppers.

Conclusion

In conclusion, as part of our regular Market Research in Thailand, we have deduced that the digital revolution in Thailand has undeniably fueled the remarkable growth of eCommerce in the country. Increased internet penetration, smartphone adoption, improved logistics, and widespread e-payment systems have created a vibrant online marketplace that attracts local and international players. However, challenges related to security issues and consumer trust still persist and must be addressed by businesses. By prioritizing security measures, fostering transparency, and building trust, businesses can further unlock the Thai eCommerce market’s immense potential and ensure its future sustained growth.