The vibrant and ever-evolving world of K-beauty has taken the global skincare industry by storm, a testament to the blend of innovation, tradition, and quality of skincare in South Korea that has positioned the country as a leader in the beauty industry. “K-Beauty,” short for Korean Beauty, represents South Korea’s influential beauty sector and has become so prominent that retail cosmetic stores often dedicate whole sections exclusively to these products, where they vie for consumers’ attention alongside established beauty categories.

For Brand Managers and marketers, the rise of K-Beauty presents a vast ocean of opportunities. The multi-step nature of the skincare regimens introduces an extensive range of product categories to explore, each with its potential for differentiation and branding.

Competition in this sector is fierce, with marketers and brand managers competing for market share across varied segments. The strategy isn’t just about pricing or packaging; it’s about creating holistic product experiences. Leveraging influencers, crafting compelling narratives, and understanding the evolving consumer behaviours of the K-Beauty market are all crucial.

The rewards can be substantial for those willing to dive into this market. Understanding K-Beauty is not just about understanding a trend, but a shift in consumer perception of beauty, wellness, and self-care.

In 2023, we surveyed 189 skincare users, offering rich insights into their habits, preferences, and perspectives regarding South Korean skincare and cosmetics. Discover the results of this research below.

Overview of the South Korea Skincare and Cosmetics Market

This rising trend has significantly bolstered the market prospects for the K-beauty industry. Reinforcing its global footprint, the United States International Trade Administration recognized South Korea as one of the top ten markets globally in terms of market share. In 2022, it had a market size estimated at $3.9 billion. It was also the fourth largest cosmetics exporter after France, the United States, and Germany.

The demand for Korean beauty products is also both global and local. Young women reportedly dedicate between $500 to $700 monthly solely to skin care, as detailed in Elise Hu’s book, “Flawless: Lessons in Looks and Culture from the K-Beauty Capital.”

History and The Rise of K-Beauty and Skincare in South Korea

The rise of K-beauty is largely driven by the global popularity of Korean culture, known as the Hallyu wave, which includes the worldwide distribution of Korean entertainment and fashion. This trend led to an increase in global exports of Korean beauty products.

Although this momentum experienced a decline at the beginning of the 2020s, with the market shrinking to $6.8 billion in 2020 from $9.4 billion as a result of the COVID-19 pandemic, the industry, with its resilience and innovation, found a new catalyst for growth in the digital realm, particularly through social media.

TikTok, in particular, has played a key role in the resurgence of K-beauty brands. Products promising the “Korean glass skin” look have gone viral on the platform, leading to a 134% increase in demand over six months ending in April 2023. Consequently, brands like Laneige, Innisfree, Beauty of Joseon, and Cosrx have become household names almost overnight, thanks to their viral fame on the platform.

This viral nature of certain K-beauty products, alongside endorsements by celebrities and user-generated content, has dramatically amplified product awareness and driven sales. The spread of K-beauty trends across social media has not only boosted the profile of specific brands but has also reignited interest in the core principles of K-beauty itself: meticulous skincare routines, innovative ingredients, and the promise of a flawless complexion.

Korean’s Beauty Shopping Habits

Koreans are renowned for their flawless, glass-like skin, and their dedication to achieving this coveted complexion is reflected in their beauty shopping habits.

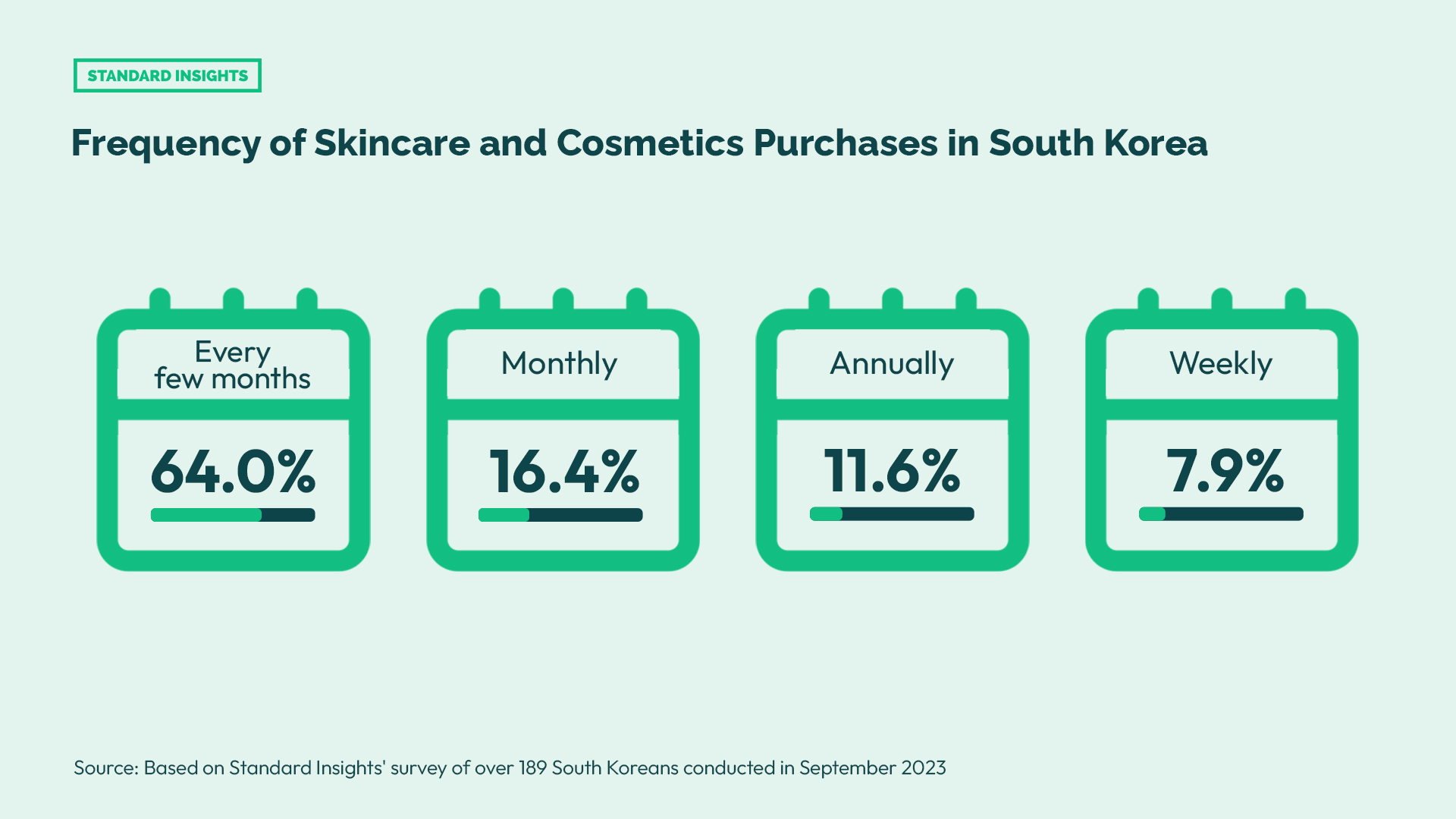

Our recent survey revealed that frequent beauty shopping is part of the habit for the majority of Koreans, with 64% indulging every few months, followed by a devoted 16.4% who can’t resist a monthly treat.

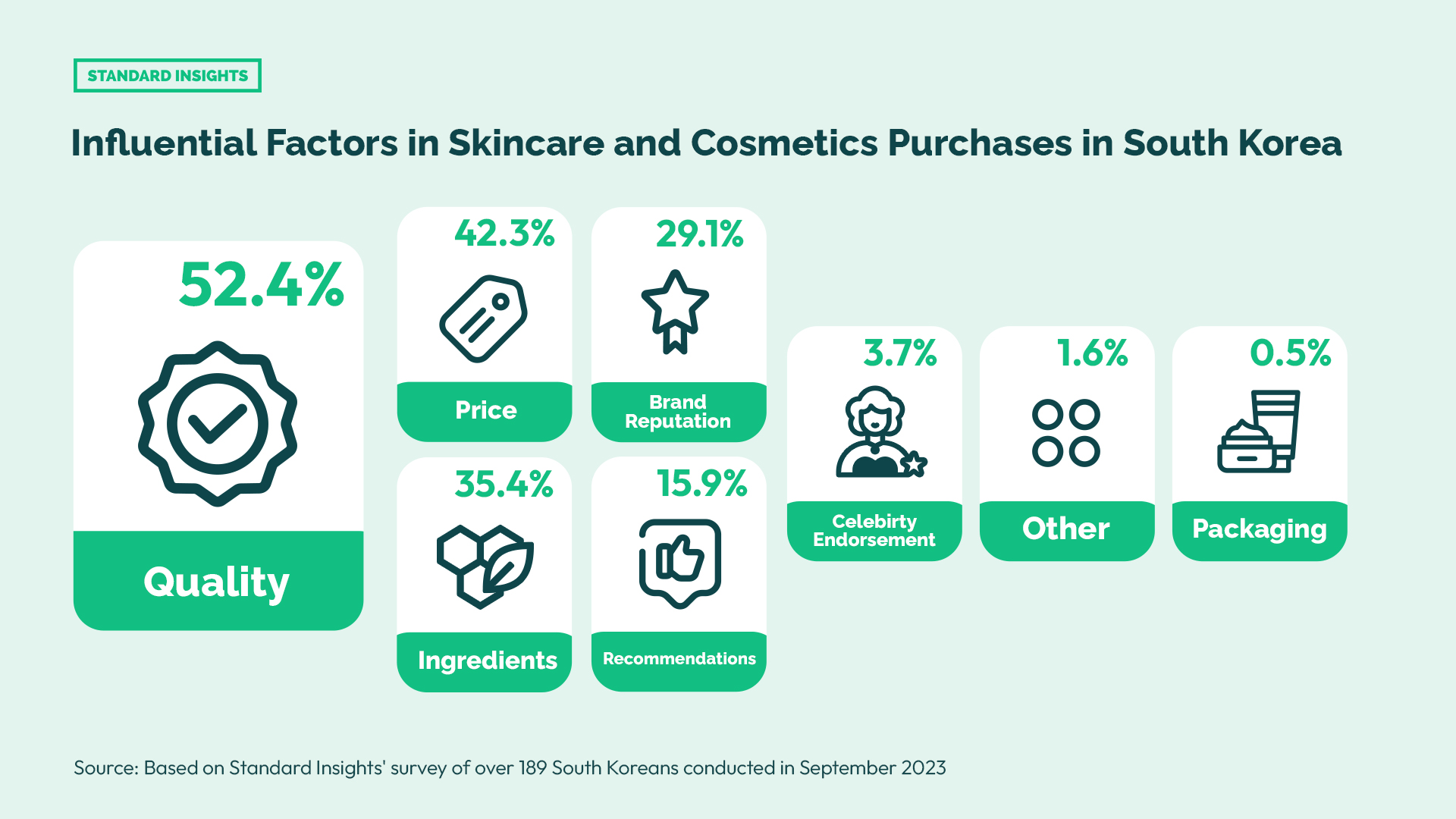

Among Koreans, choosing the perfect beauty products comes down to three things: quality, price, and special ingredients. With over half of the respondents (52.4%) seeking top-notch quality, and 42.3% keeping an eye on the budget. Brand reputation (29.1%) also has its sway, but it’s those carefully curated ingredients (35.4%) that often steal the spotlight.

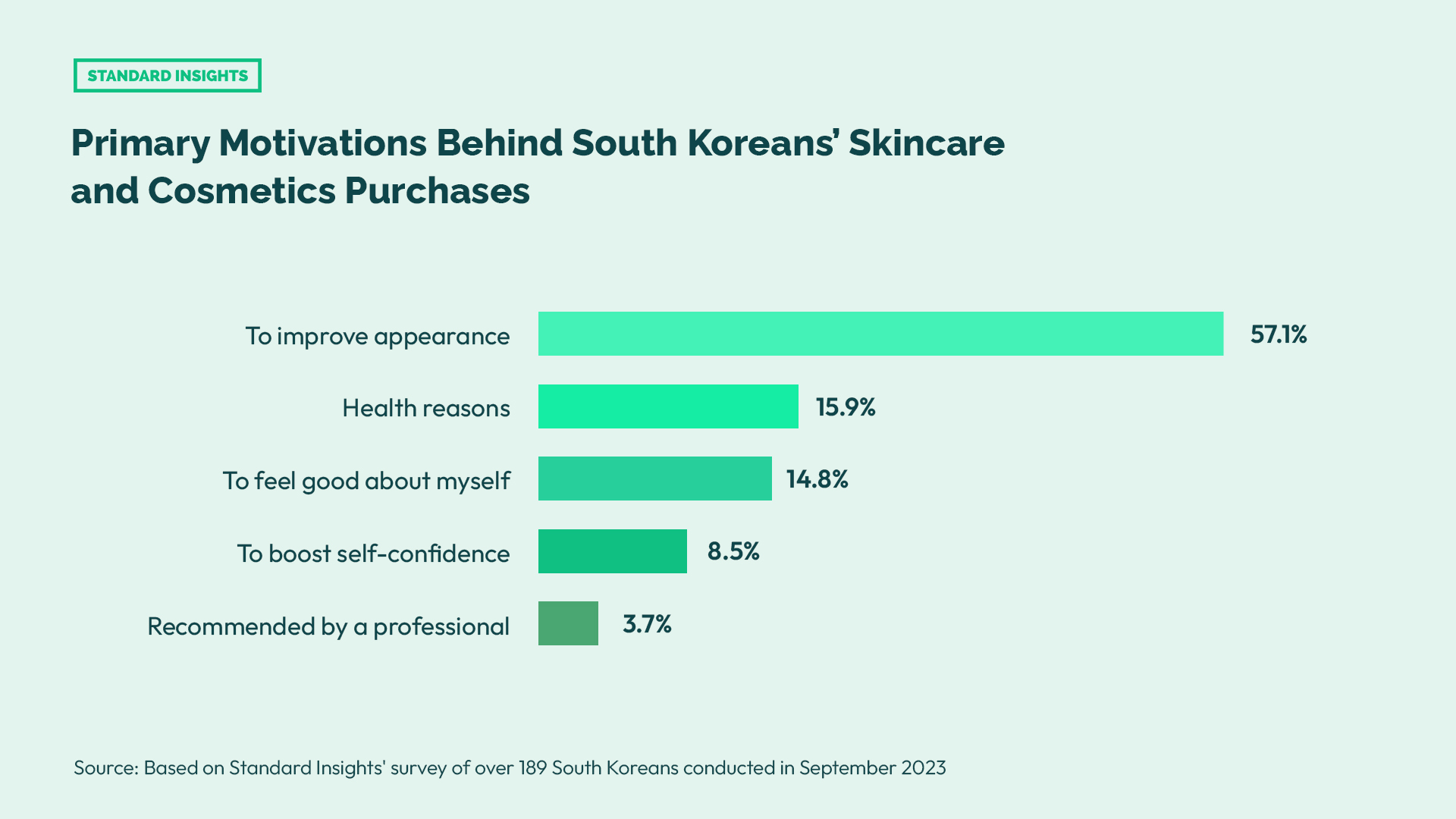

Improving appearance is the main reason behind Korean consumers’ skincare and cosmetics purchases. Over half (57.1%) of respondents said they purchase products to improve their appearance. For others, they put on cosmetics and skincare for health (15.9%) and to feel good about themselves (14.8%).

Going Green and Natural

In response to environmentally conscious consumers’ preference for eco-friendly packaging and organic goods, the industry is witnessing a wave of green and sustainable practices, catapulting these eco-conscious choices into the list of top fave products.

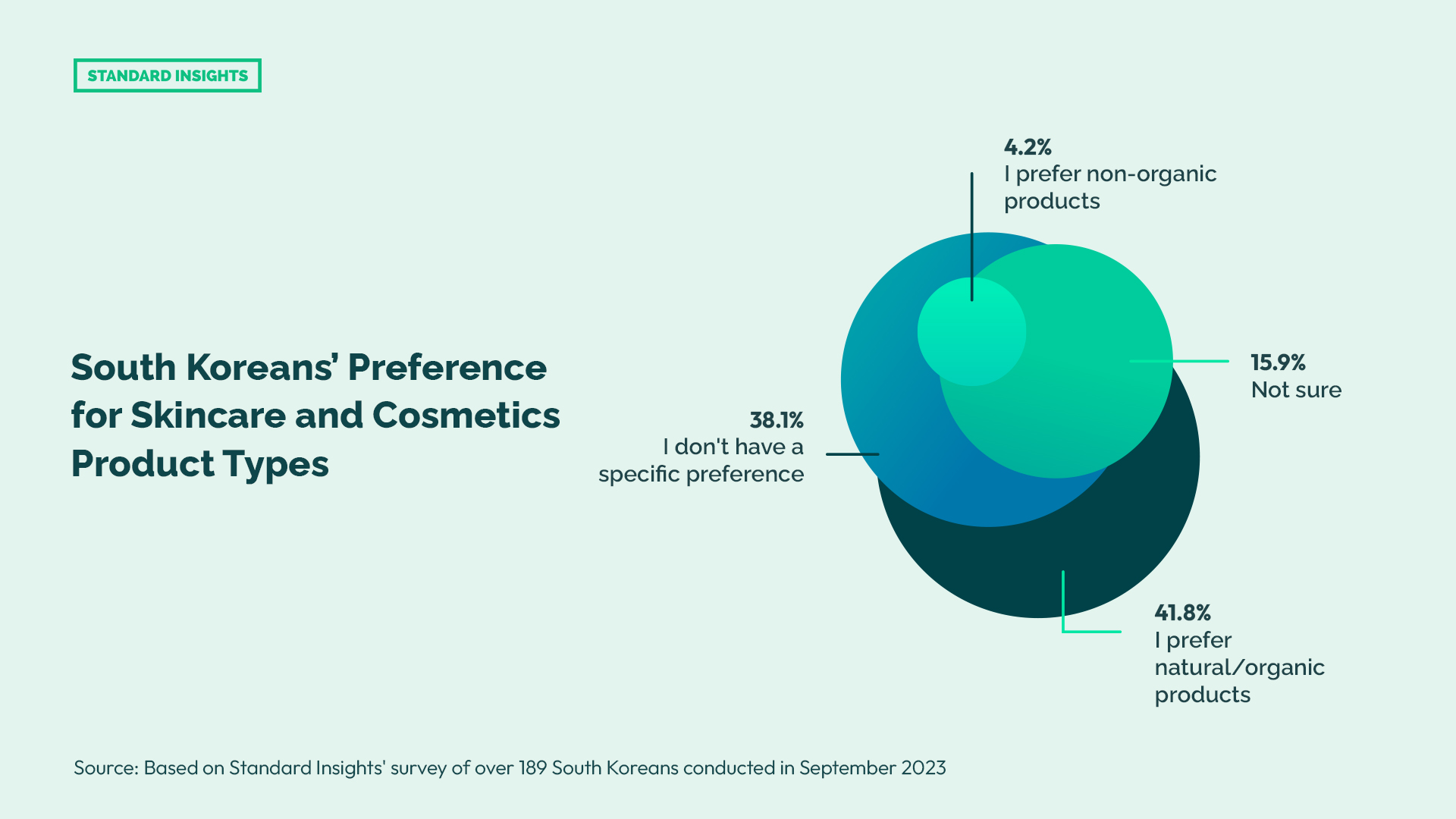

This is evident in the recent survey results, where 41.8% of Koreans revealed a strong preference for natural and organic products. Only 4.2% of respondents said they prefer non-organic products, while 38.1% said they have no specific preference.

And it’s not just about what makes a product – Koreans are also conscious of the impact of the packaging on the planet. A significant 16.5% emphasize the importance of sustainable packaging, showing that their love for beauty goes hand in hand with a commitment to the environment.

In response to the demand for sustainable packaging, several businesses are ramping up their efforts, a move catalyzed by the Korea Cosmetic Association’s launch of the 2030 Cosmetics Plastic Initiative. This initiative seeks to eliminate non-recyclable materials by 2030. This gained support from industry giants such as L`Oreal, LG Household & Health Care, and Aekyung.

In the same year, Laneige, one of the top skincare brands in South Korea, used recycled packaging developed by Eastman Technologies on one of its products.

Additionally, the Korean brand AMOREPACIFIC has initiated the ‘2030 AMORE Beautiful Promise‘, pledging to foster sustainable consumption, support societal improvement, tackle climate change, and harmonise with nature through committed brand actions by 2030. Their strategies include making all new products environmentally and socially friendly, embracing diversity and inclusion, achieving carbon neutrality, zero waste to landfill, reducing plastic usage in packaging, and investing in biodiversity with a significant increase in certified sustainable palm oil. In June 2023, we conducted a comprehensive survey among the population of South Korea to gain valuable insights into the positioning and brand perception of AMOREPACIFIC. Book a demo with us today to access the complete data.

Online Shopping

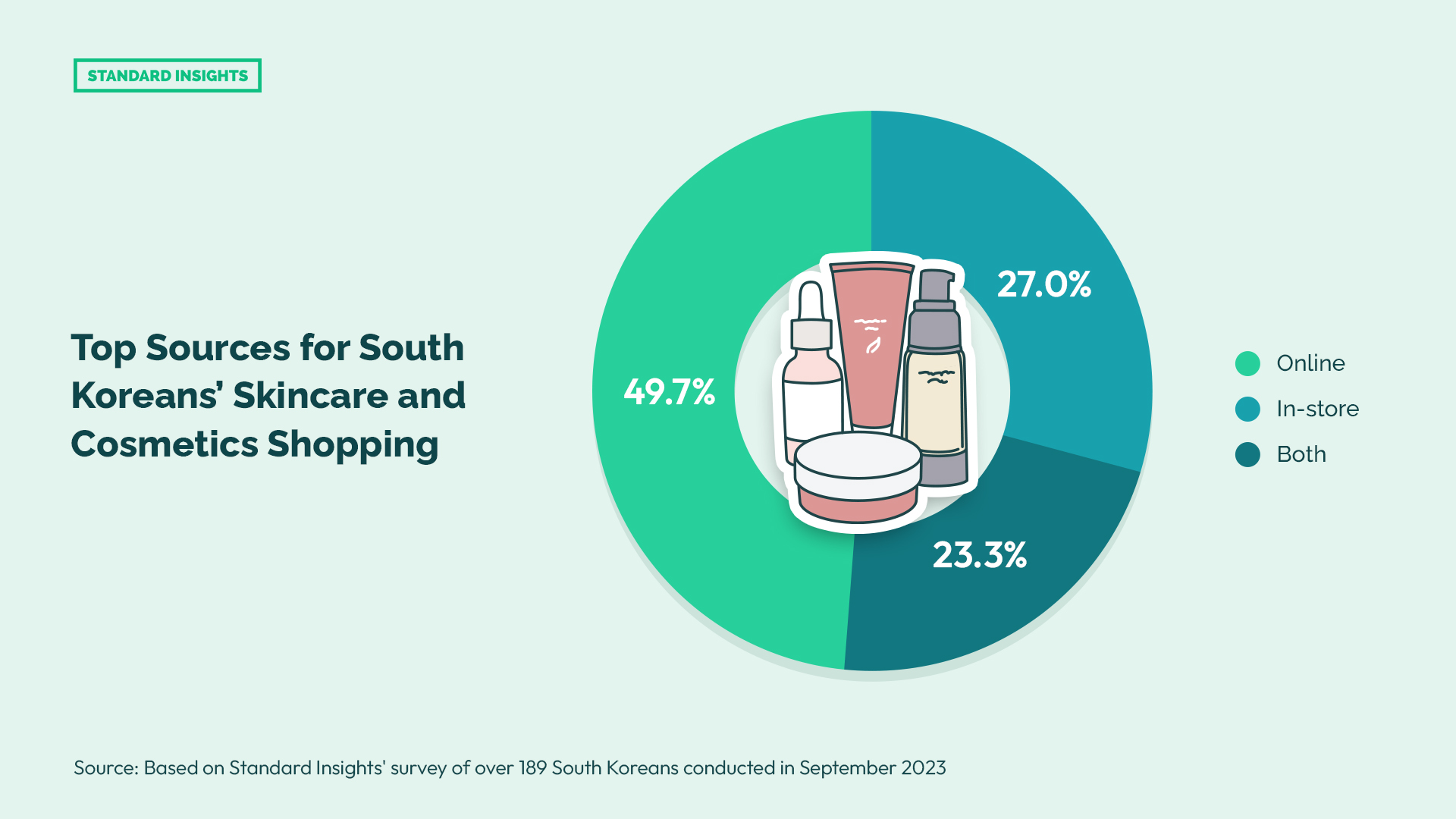

The influence of e-commerce on beauty shopping is undeniable, as demonstrated by 49.7% of respondents opting for the convenience of online shopping. The allure of the traditional in-store experience still exists, with 27% enjoying the touch and feel before making their final choices.

The digital world plays a significant role in shaping beauty choices, with online reviews (58.7%) and social media (33.9%) serving as go-to guides. On the other hand, the traditional word-of-mouth approach – recommendations from friends and family (29.1%) still holds its place in the hearts of our Korean beauty enthusiasts.

Standard Insight’s survey also revealed that many Korean consumers are open to trying new brands. About a third of the people surveyed, 33.8%, said they would probably try a new brand. 16.9% were very likely to try something new, while 26.5% said they were likely to do so. This shows that many people are interested in experimenting with different products in the beauty industry.

To Wrap Up

The opportunities within the K-Beauty industry are simply too massive to ignore. As a global leader revolutionizing the skincare world, Korea has demonstrated an unparalleled dedication to innovation, education, and delivering real consumer results. But let’s be clear – this is no accidental success story.

The brands dominating the K-Beauty sector have mastered customer engagement, community building, and translating complex routines into digestible steps that empower people to take control of their skin health. They understand prevention is key, affordability expands your audience, and sustainability is no longer a nice-to-have but a must-have in today’s increasingly eco-conscious environment.

Most importantly, from the second a new product launches, Korean marketers are already five steps ahead in planning their next strategic move. They track trends relentlessly and adapt on the fly, keeping consumers always wondering what’s next while effortlessly strengthening emotional connections.

For outsiders hoping to break into this hyper-competitive space, the learning curve will be steep. But for those willing to fully immerse themselves in the K-Beauty mindset of constant evolution and embrace both the art and science of their processes, the rewards could be exponential. This is the future of the global beauty industry, and it’s one you don’t want to be late to.