The COVID-19 pandemic triggered a surge in health and wellbeing concerns, driving people worldwide to pay closer attention to insurance—including in Thailand. The crisis disrupted insurance operations across the country, rapidly shifting consumer needs and expectations. Insurers were pushed to adapt, embracing more digital, contactless, and customer-focused models almost overnight.

To better understand these changes, in 2022 we surveyed over 500 Thai consumers about their views, ownership, and preferences regarding insurance. This research was designed in partnership with the InsurTech company OneDegree. The results uncover the key factors influencing insurance decisions in Thailand and highlight the top trends shaping the industry’s evolution.

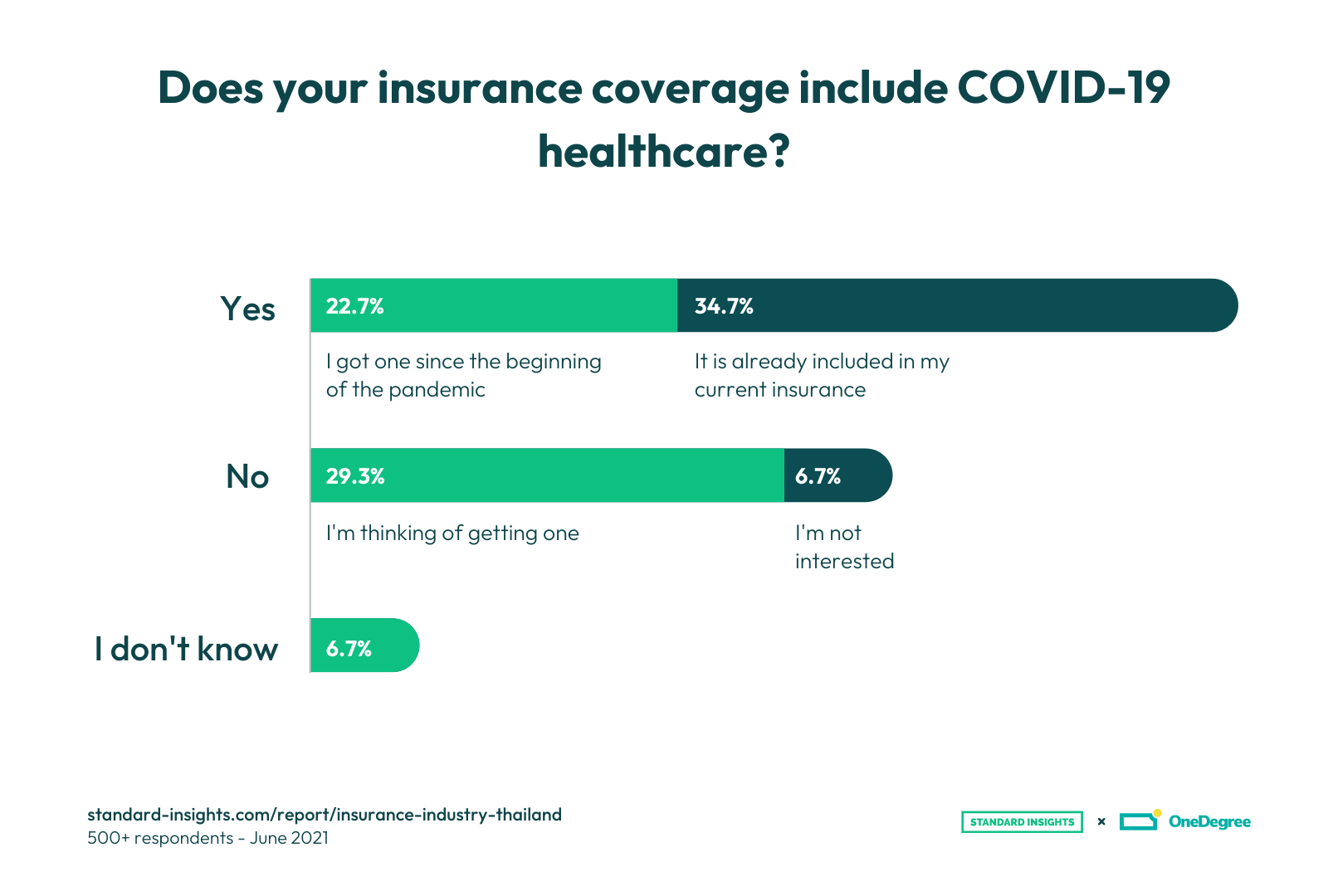

According to our survey, more than half of the Thai respondents (57%) have COVID-19 coverage through their insurance. It highlights the importance given to this coverage in Thailand.

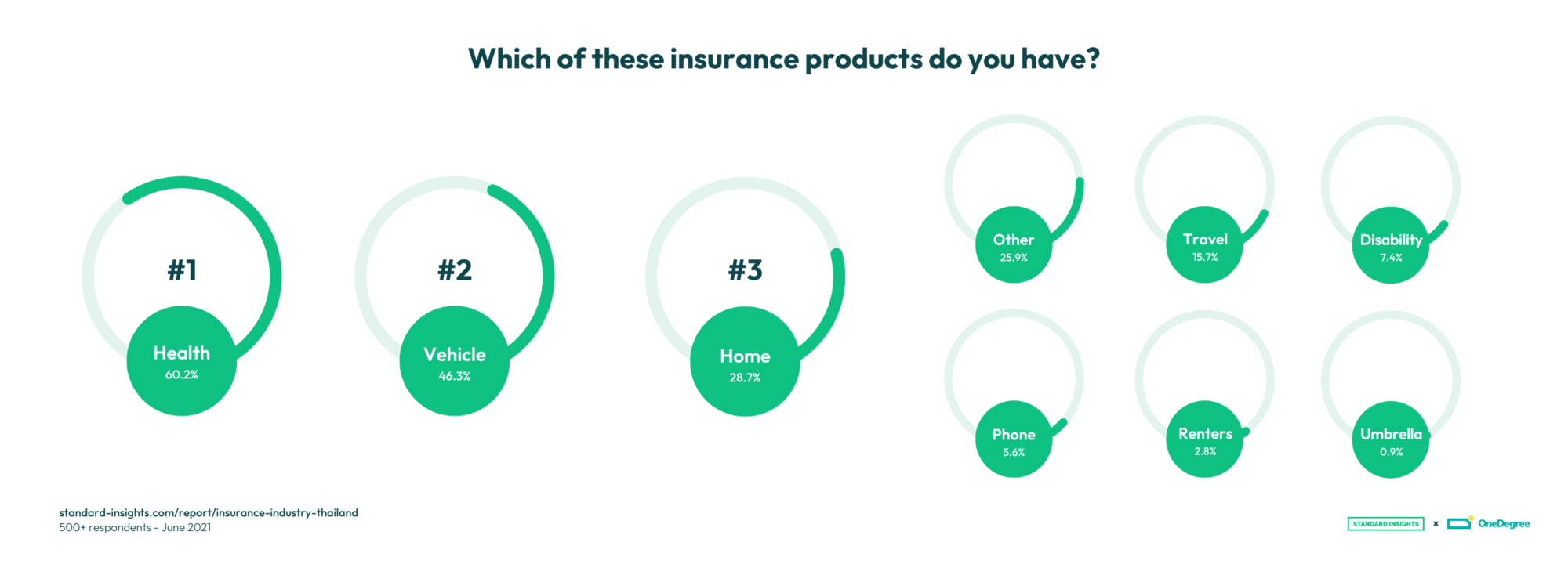

Regarding top insurance products, health insurance is the most owned product in Thailand (60%), followed by vehicle Insurance (46%), and home insurance (29%).

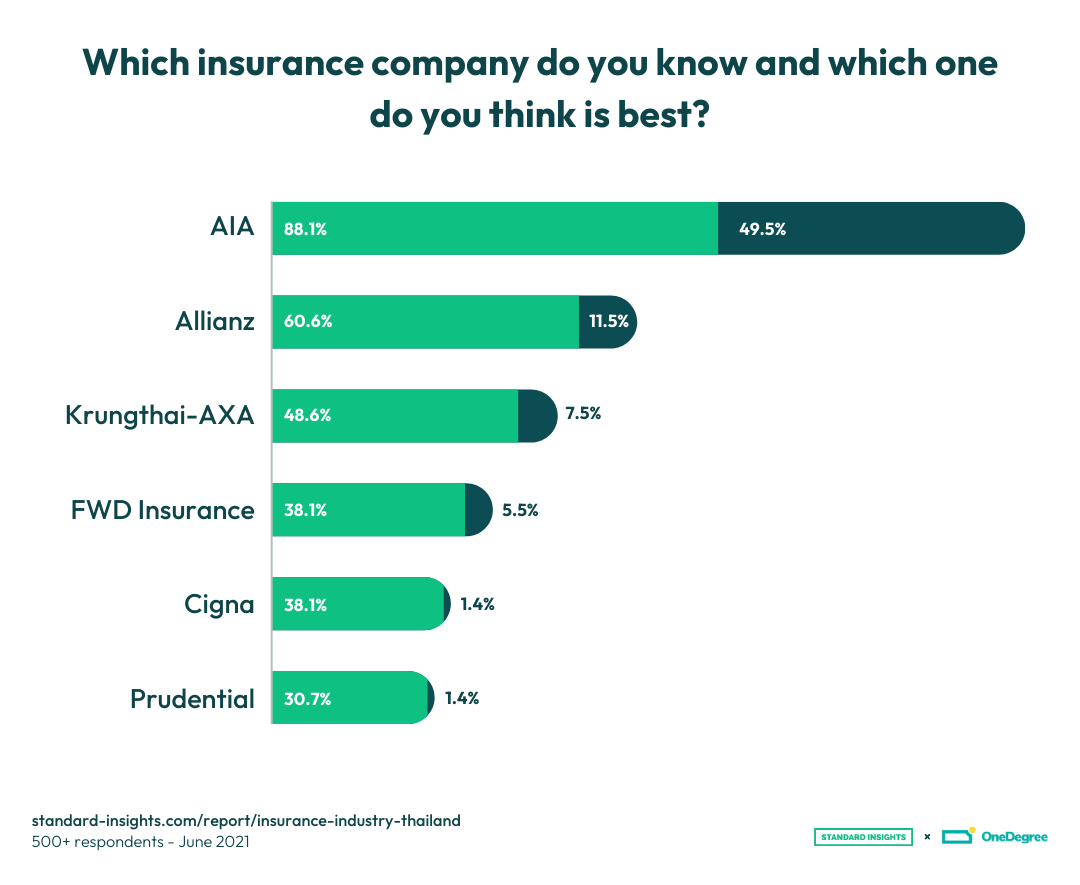

When the respondents were asked about insurance companies they know and consider the best, AIA came first for the majority.

And 50.6% said they are currently satisfied and plan to keep the relationship with their insurance company.

What Drives Insurance Purchases in Thailand?

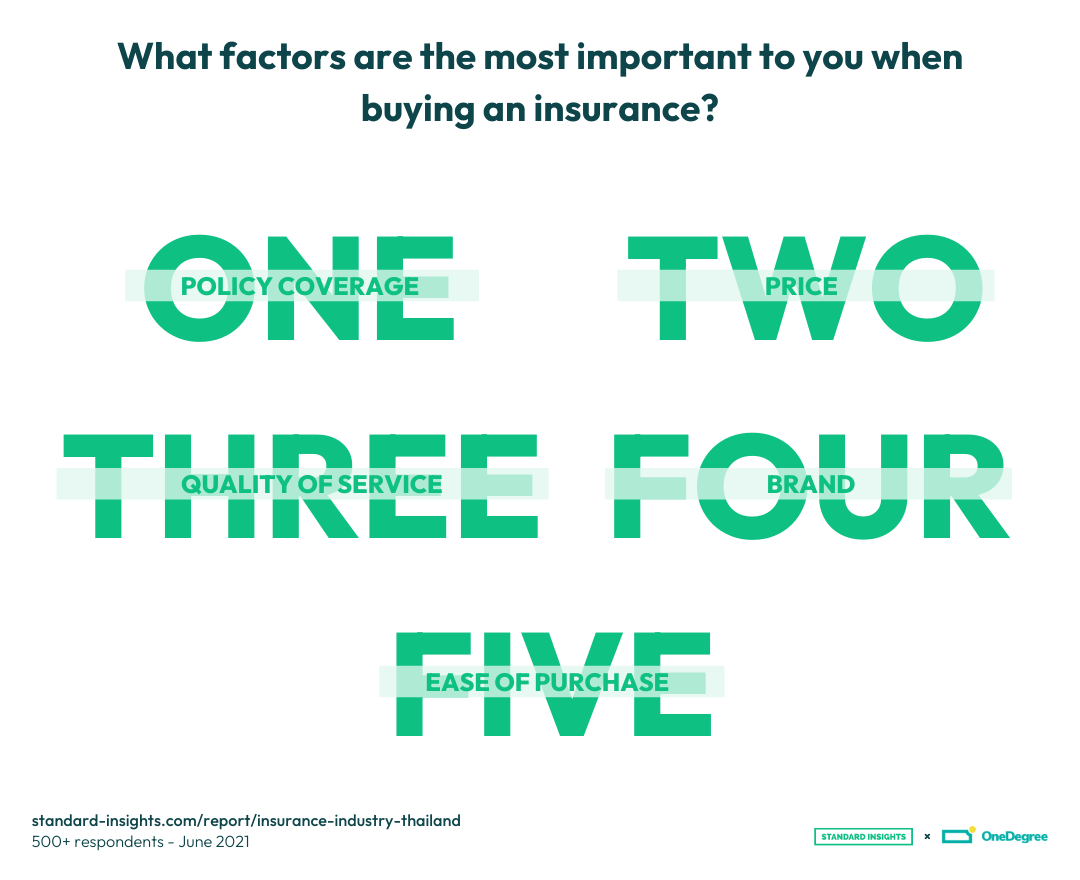

Many factors influence a buyer’s decision to purchase insurance products or services. However, this article will pinpoint the four most impacting factors. So keep scrolling down and figure it out with us!

1. Policy Coverage: Top Priority

Insurance coverage helps clients recover financially from unforeseen events, such as automobile accidents or the loss of a family’s income-producing adult. The insured individual pays a premium to the insurance company in return for this coverage. Many factors frequently impact insurance coverage and prices.

The insurer manages risk by charging premiums. For example, when there is a greater probability that an insurance carrier may have to pay out money toward a claim, they can address the risk by charging a higher premium.

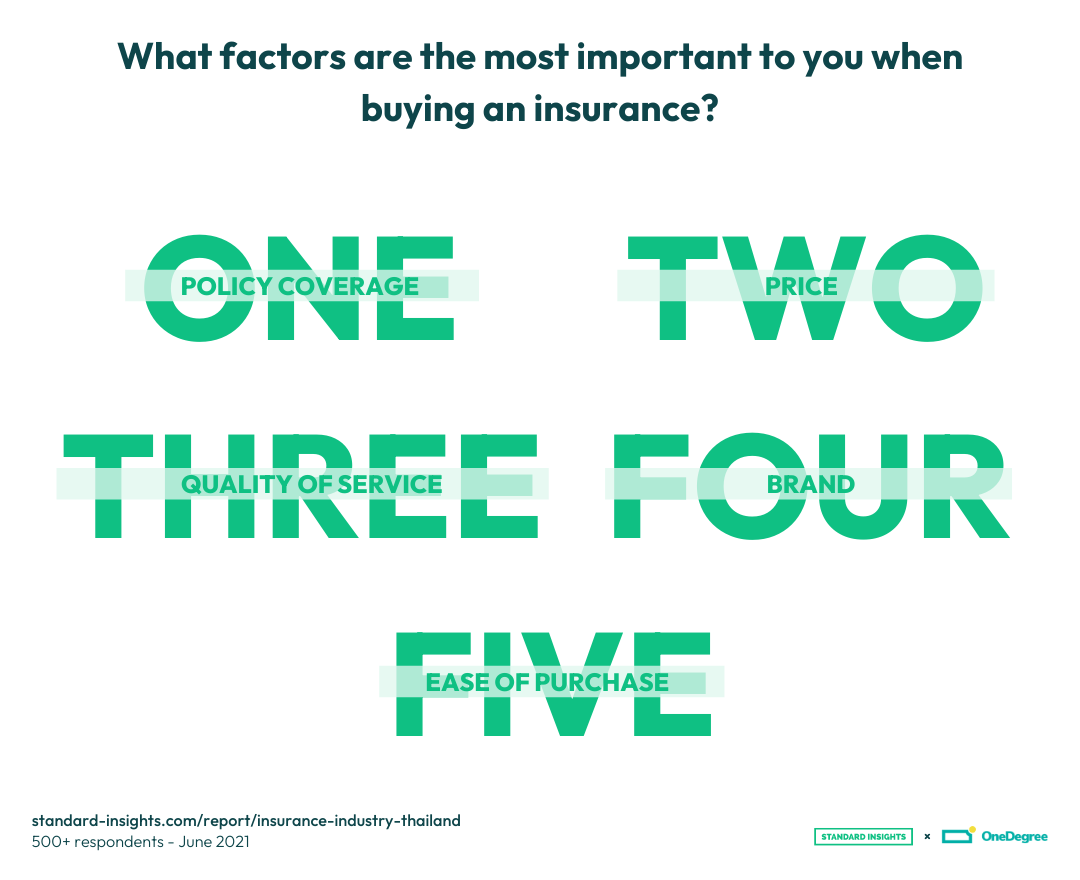

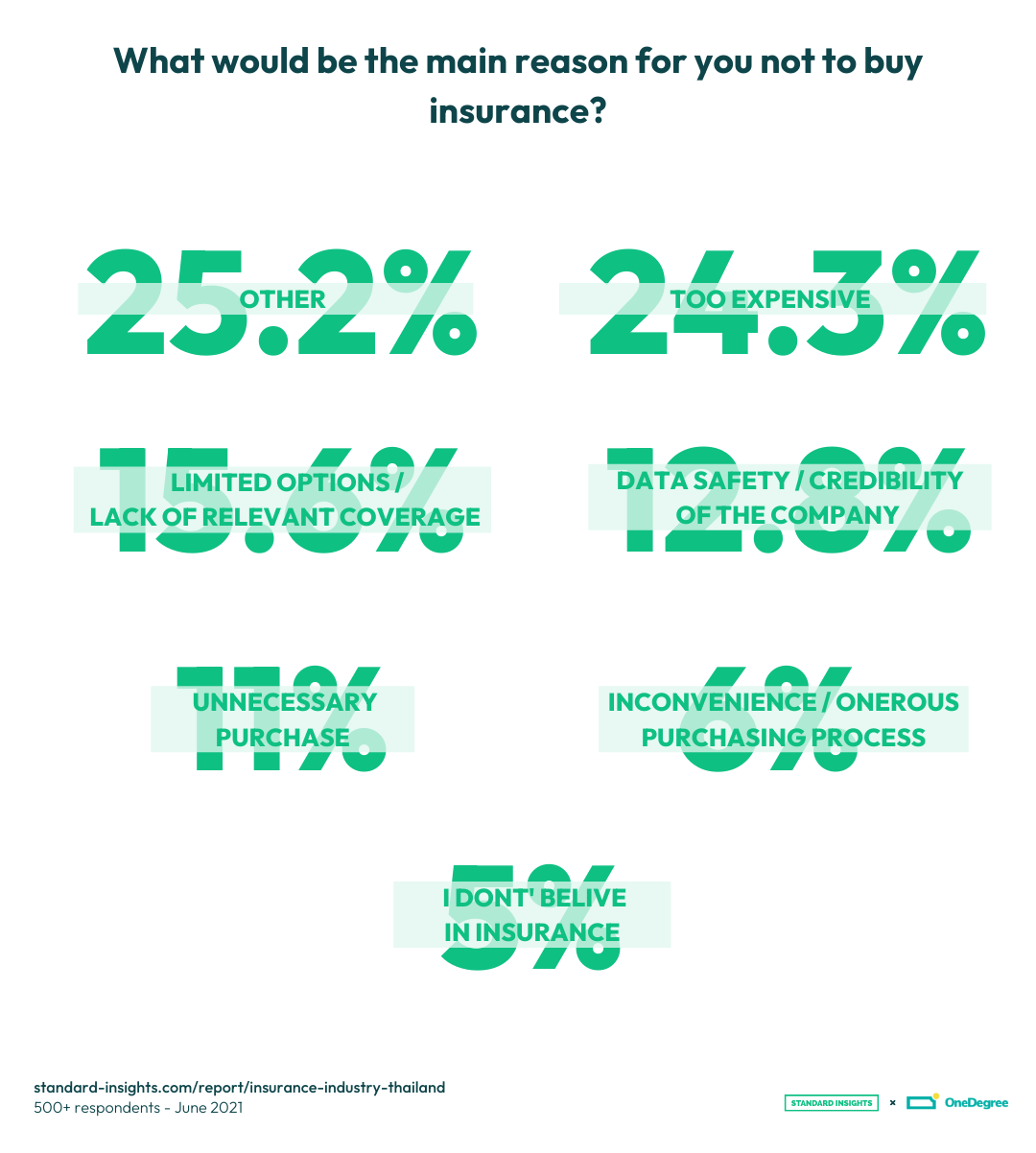

Most Thai respondents considered policy coverage an essential factor when purchasing insurance. In addition, 15.6% of them also shared that they did not buy insurance due to the company not offering appropriate coverage.

That’s why many Thai people choose not to purchase insurance if it is too expensive (24.3% – according to our survey). Moreover, price is also considered the second important factor influencing people’s insurance purchase decisions.

2. Price Sensitivity Among Thai Buyers

Consumers frequently correlate price with product level, implying that a perceived high price represents good quality and vice versa. Furthermore, one of the things that boosts brand image is pricing. As a result, both brand image and pricing are essential determinants in purchasing decisions.

That’s why many Thai people choose not to purchase insurance if it is too expensive (24.3% – according to our survey). Moreover, price is also considered the second important factor influencing people’s insurance purchase decisions.

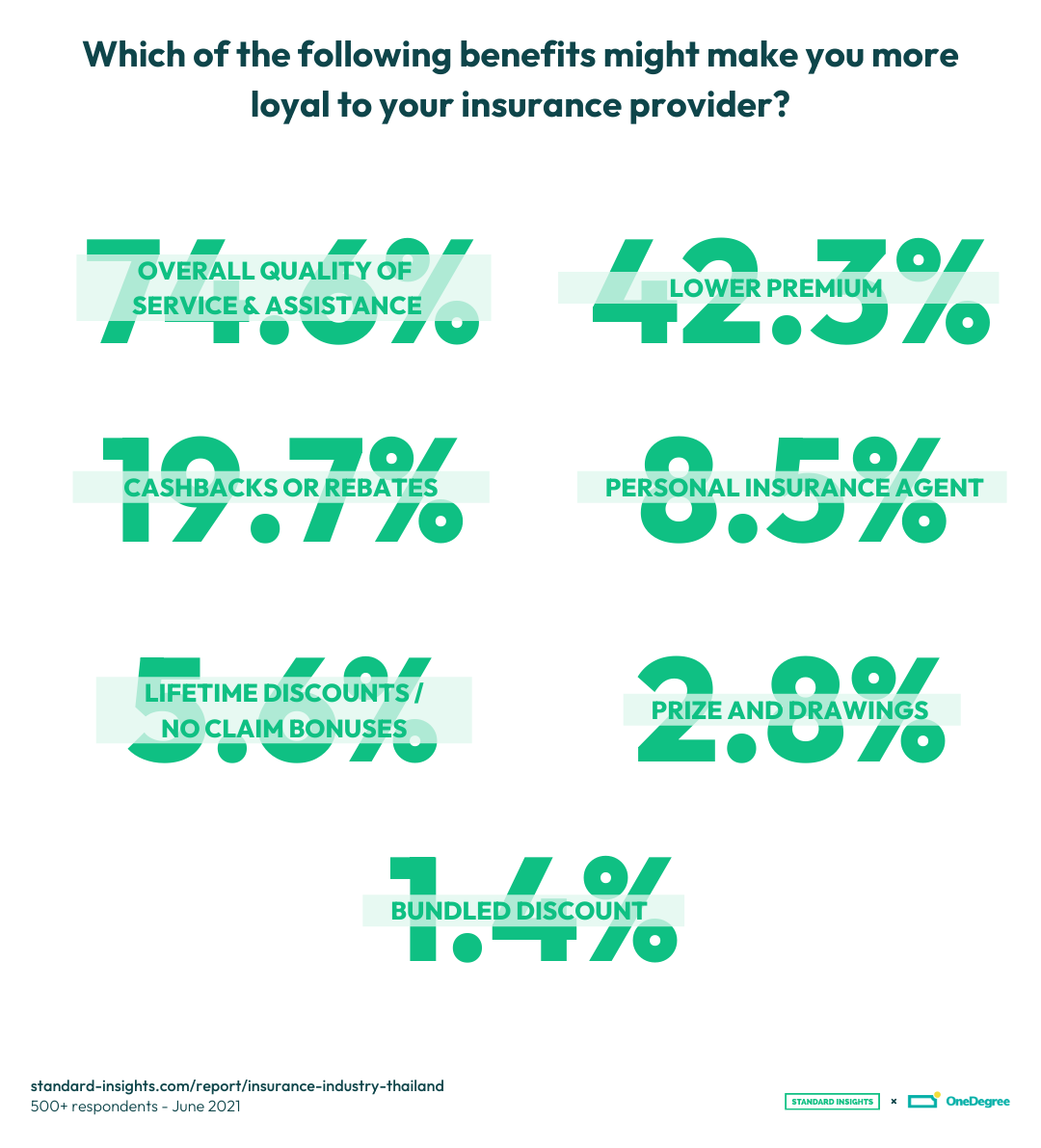

3. Quality of Service and Customer Loyalty

Quality service is what sets you apart from competitors. Total client happiness is the outcome of high-quality service. When your clients are satisfied, they will tell others; when they are dissatisfied, they will also tell others. That is why favorable word-of-mouth is pivotal for every company!

People in Thailand also rank the quality of service factor as third when considering buying insurance. Therefore, insurance companies must improve the quality of service to their best if they want:

- Higher profit margins without losing customers

- More referrals

- Lower sales/ marketing costs

- Repeat purchases

- Greater customer loyalty

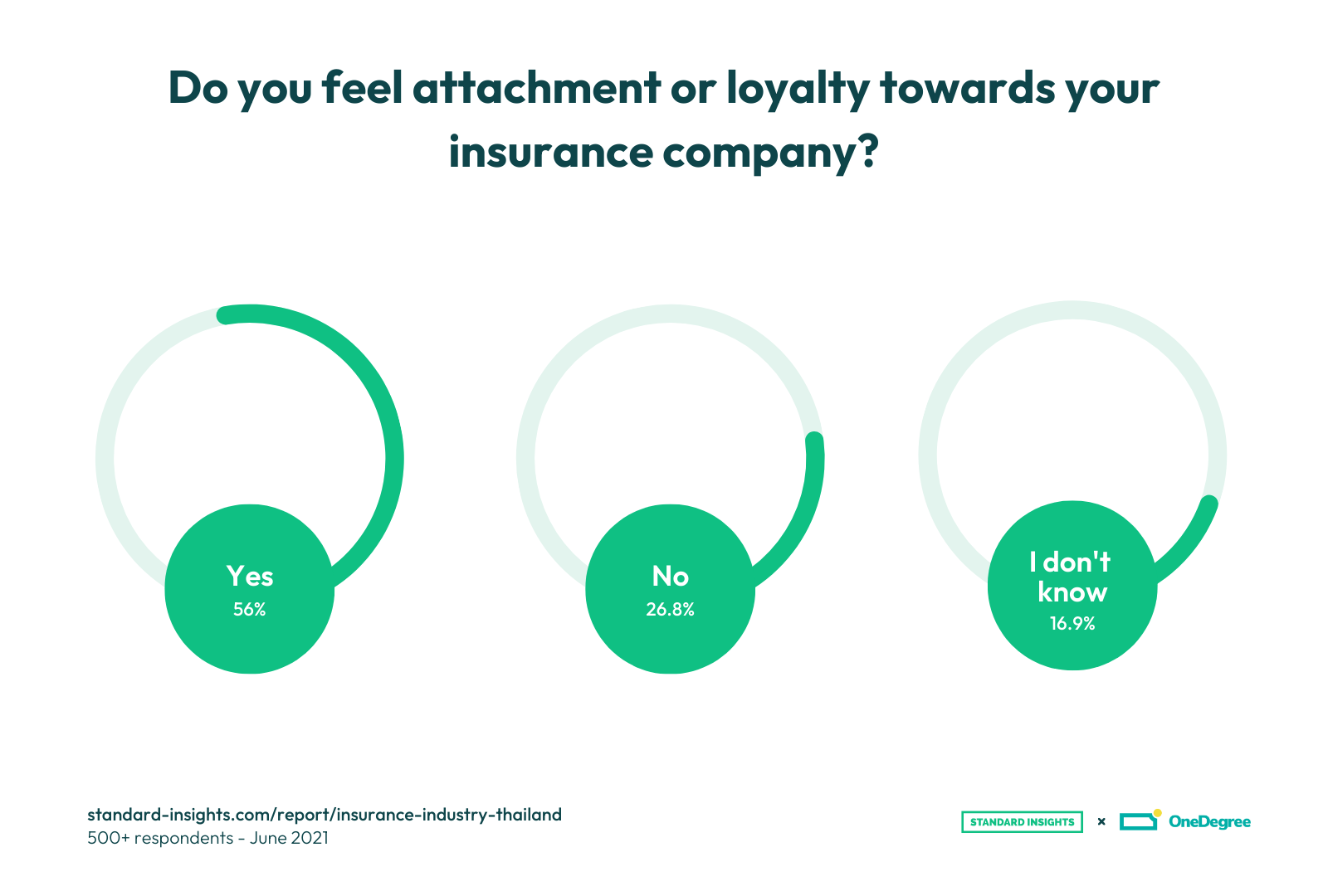

Our survey also shows that 74.6% of Thai people supposed that overall service quality and assistance significantly impact their loyalty toward an insurance provider.

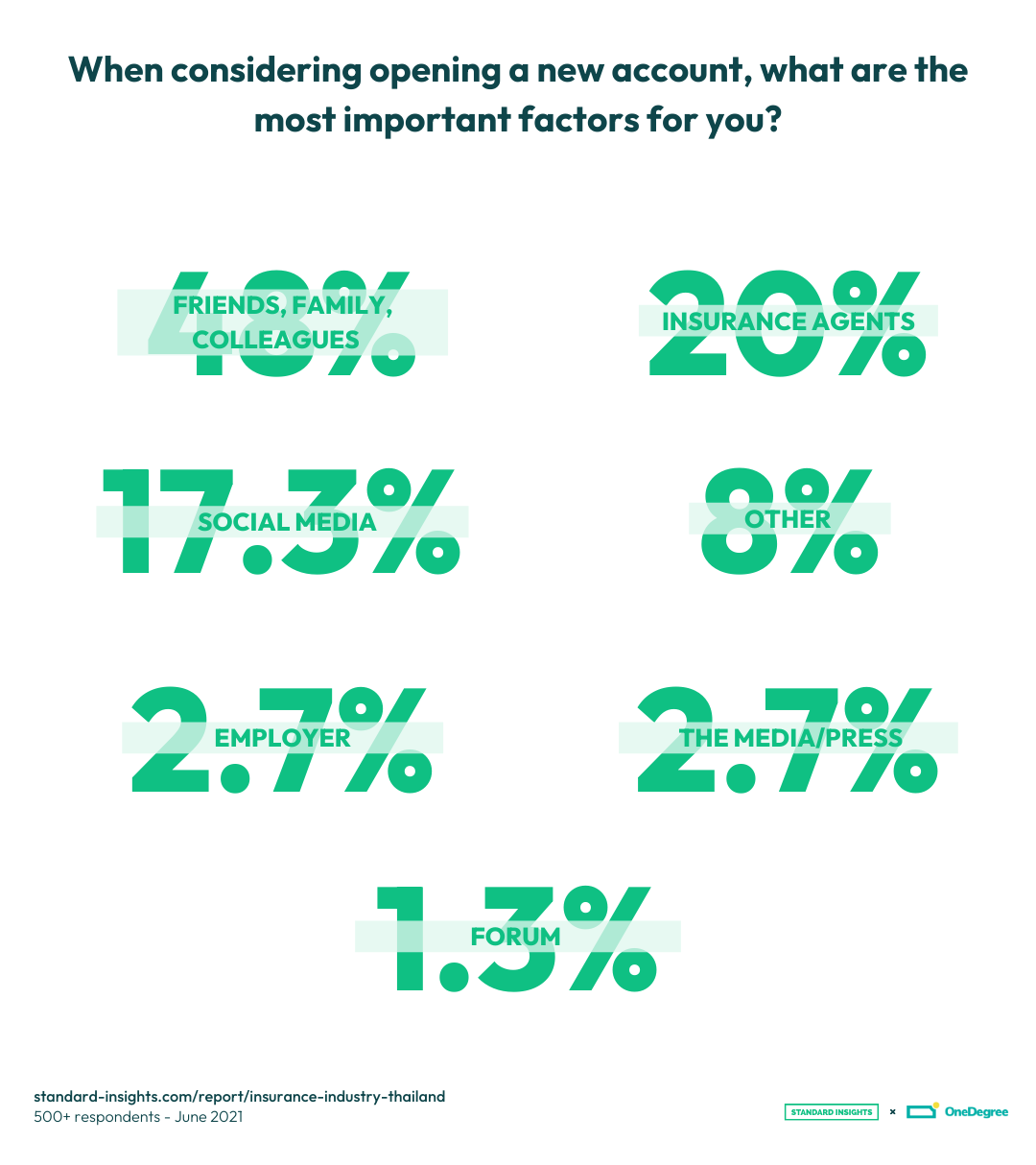

4. Word of Mouth

Word-of-mouth (WOM) occurs when customers tell their friends, family, and those with close ties about a company’s product or service.

Specifically, when it comes to purchasing an insurance policy, 48% are influenced by friends, family, and coworkers, while 20% are influenced by insurance agents, according to our survey.

Buyers are more emotionally attached to a brand when they sense the company is listening to them. As a result, many companies have sales representatives discuss their products and services with customers in person or via a phone call. This engagement and promotional event may ignite conversations about a company’s product.

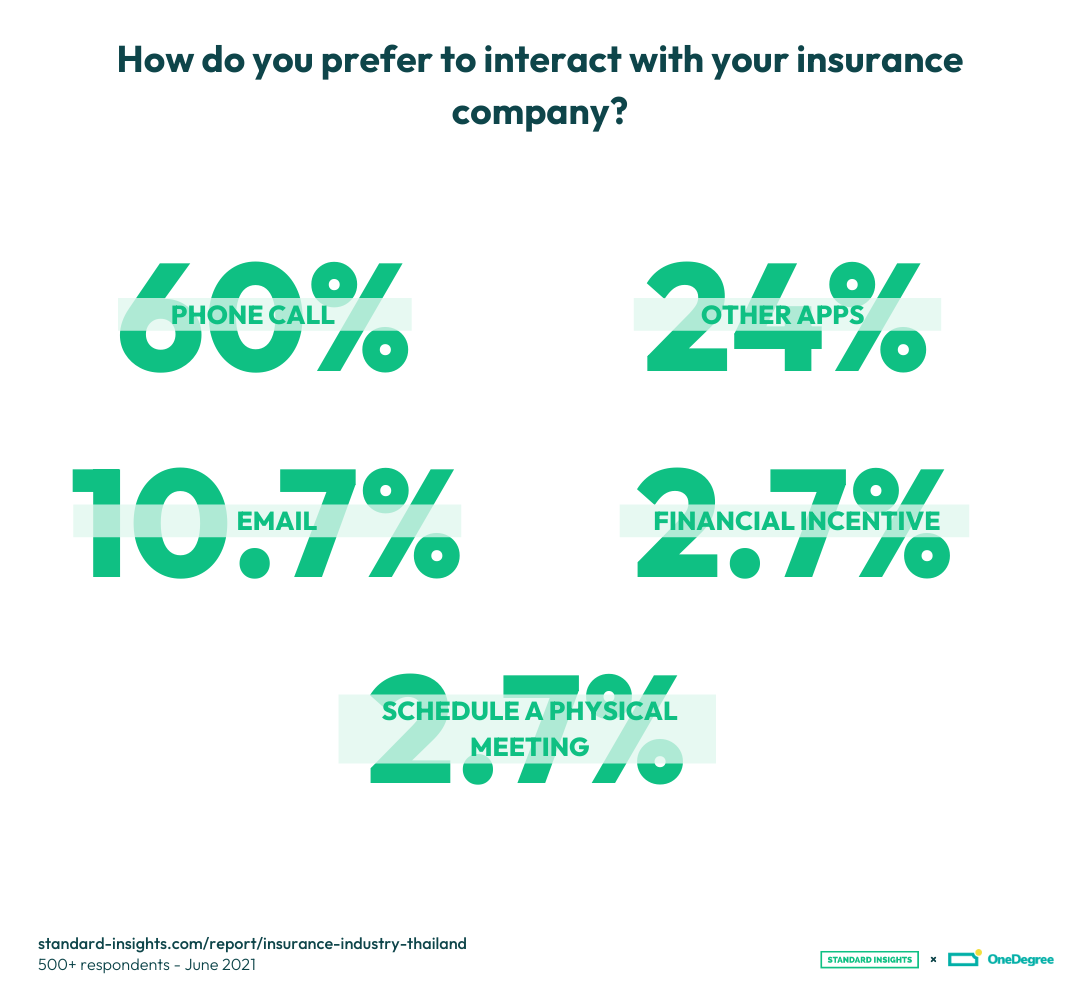

In our survey, most respondents (60%) confirmed that they preferred to interact with their insurance company through phone calls.

The Future of the Insurance Industry in Thailand

According to a recent AM Best analysis, despite a COVID-19-led economic contraction in Thailand in 2020, the country’s insurance industry expanded, driven by substantial growth in the health category.

Government-imposed COVID-19 containment measures have spurred digitization and innovation in Thailand’s insurance market, as firms compete for a share of the kingdom’s highly dynamic and evolving insurance sector.

In the insurance industry, digital transformation can enable operational efficiency, vary distribution, and bolster product development and pricing capabilities.

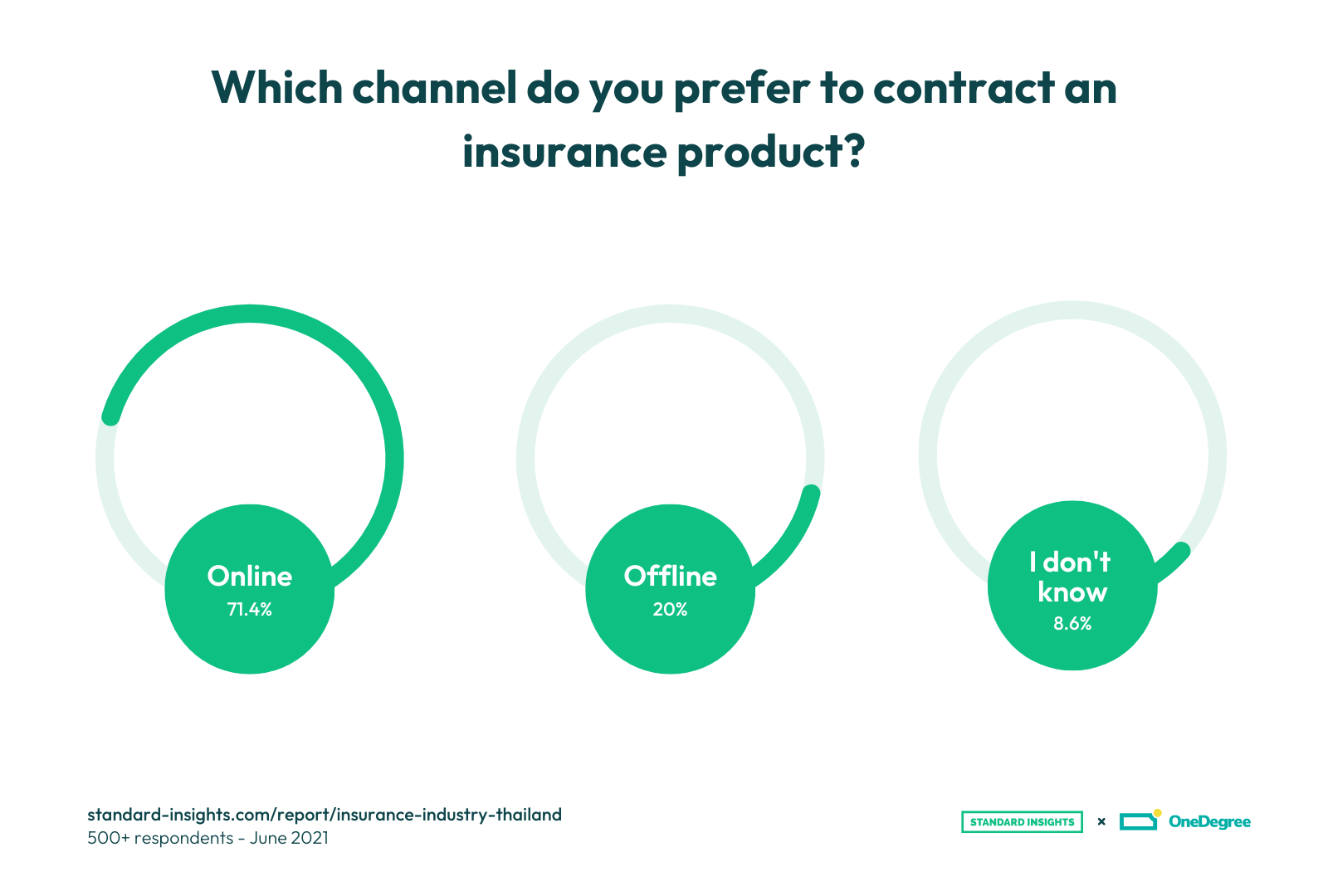

According to a new poll by Standard Insights, Thai buyers want a better digital experience from their insurance. In addition, more than 71.4% of policy-owning respondents in Thailand stated they preferred to contract an insurance product online.

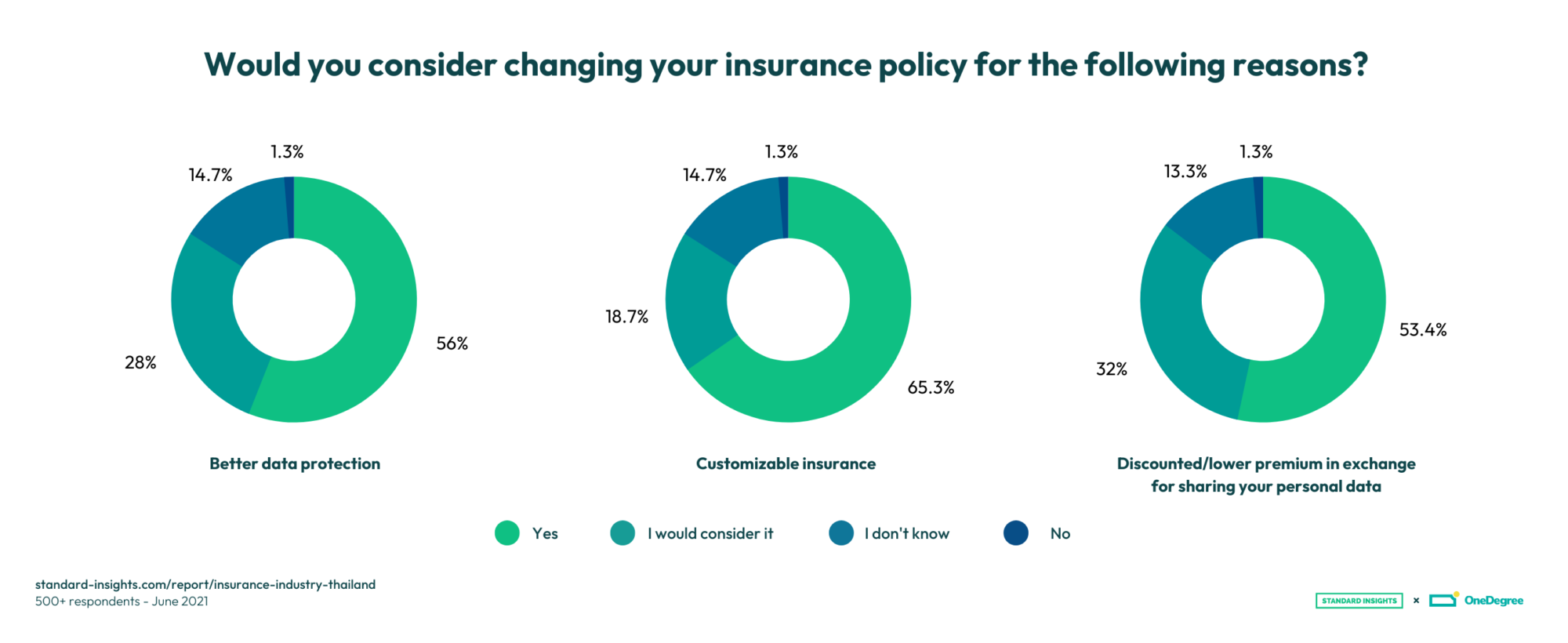

Almost a third of the respondents would submit their personal information to receive a more tailored insurance product or lower premium. It shows an openness to disclose data in exchange for a financial counterpart.

Main Takeaways

Government and insurance providers should promote more communication to increase customer awareness about the digital transformation in the insurance sector.

In addition, integrating user-friendly digital features, offering diversified insurance policies, and improving product quality for better word of mouth are less practical. Therefore, insurance buyers might feel that what they have spent is worth it!

Want more up-to-date consumer research? Try Standard Insights platform for free—the all-in-one platform for marketers and agencies.

Frequently Asked Questions

All insights below are based on a 2022 survey of 500+ Thai consumers conducted in partnership with OneDegree.

What is the most popular type of insurance in Thailand?

Health insurance, held by 60% of respondents, is the most common due to increased health awareness post-pandemic.

How many Thais have COVID-19 insurance coverage?

57% said they have insurance covering COVID-19 as of 2022.

Which factors most influence Thai consumers when buying insurance?

Policy coverage, price, service quality, and recommendations from friends and family are the top decision factors.

How satisfied are Thai insurance customers?

About 51% said they are satisfied and intend to stay with their current provider.

How do Thais prefer to interact with their insurance company?

60% prefer phone calls, while a growing number are open to digital channels.

Are Thais open to buying insurance online?

Yes, over 71% of policyholders said they would rather buy insurance online for convenience.

What prevents some Thais from buying insurance?

The leading reasons are high premiums and insufficient policy coverage options.

Who influences insurance buying decisions in Thailand?

Friends, family, and coworkers influence 48% of buyers, while 20% are guided by insurance agents.