The rise of fintech in Hong Kong is transforming the banking landscape. But what really drives people to choose digital banking? And what matters most as banks make the leap to digital?

In 2022, in partnership with Statrys, we surveyed 300 professionals across Hong Kong to better understand their banking and fintech behaviors.

Key Takeaways:

- 65.7% of Hong Kongers have a banking app installed.

- Trust and reputation are the top factors when opening a new account.

- The three main drivers for digital bank adoption: transaction speed, value for money, and user-friendliness.

While this data reflects the 2022 landscape, the core drivers of digital adoption—speed, cost, and user experience—remain just as important for fintech marketers today.

Introduction

Hong Kong is renowned for its technological advancement. The penetration of internet access and mobile phone usage is intensively bolstered, making it a viable platform for Hong Kong’s fintech ecosystem.

Invest Hong Kong’s report shows that Hong Kong is home to approximately 600 fintech enterprises and startups. Furthermore, 86% of local banks have incorporated or plan to incorporate fintech solutions through all financial services.

The city was ranked fifth among developed markets for consumer fintech adoption. Since 2014, Hong Kong fintech businesses have raised over 1.1 billion USD in venture capital.

The Hong Kong government plans to enhance Hong Kong’s presence as a financial hub, with fintech as a primary subsector to invest in. Specifically, the Hong Kong Monetary Authority (HKMA) has identified 7 Smart Banking Initiatives:

- Research and Talent Development

- Faster Payment System

- Fintech Supervisory Sandbox

- Virtual Banking

- Banking Made Easy

- Open API

- Closer cross-border collaboration

Will the Hong Kong government’s attempts be compensated? Will citizens of the country favorably select proposed fintech banking solutions for their daily usage?

Traditional Banks Have Room For Digital Transformation

According to our digital survey, 45.6% of respondents have used more contactless payment methods since the Covid-19 outbreak. Meanwhile, 53.4% of Hong Kongers selected contactless payment solutions for their banking usage before the pandemic.

Indeed, 65.7% of Hong Kongers confirm installing a banking app on their phone. Also, 42.1% make professional payments online with high-frequency banking: weekly and monthly.

We anticipate that these trends in banking behavior will change the way people utilize bank branches. Customers who enjoy speedier onboarding and more efficient customer service on digital channels are less prone to return to the enormous queues that are commonly correlated with physical outlets.

Factors Affecting The Adoption of Digital Banking in Hong Kong

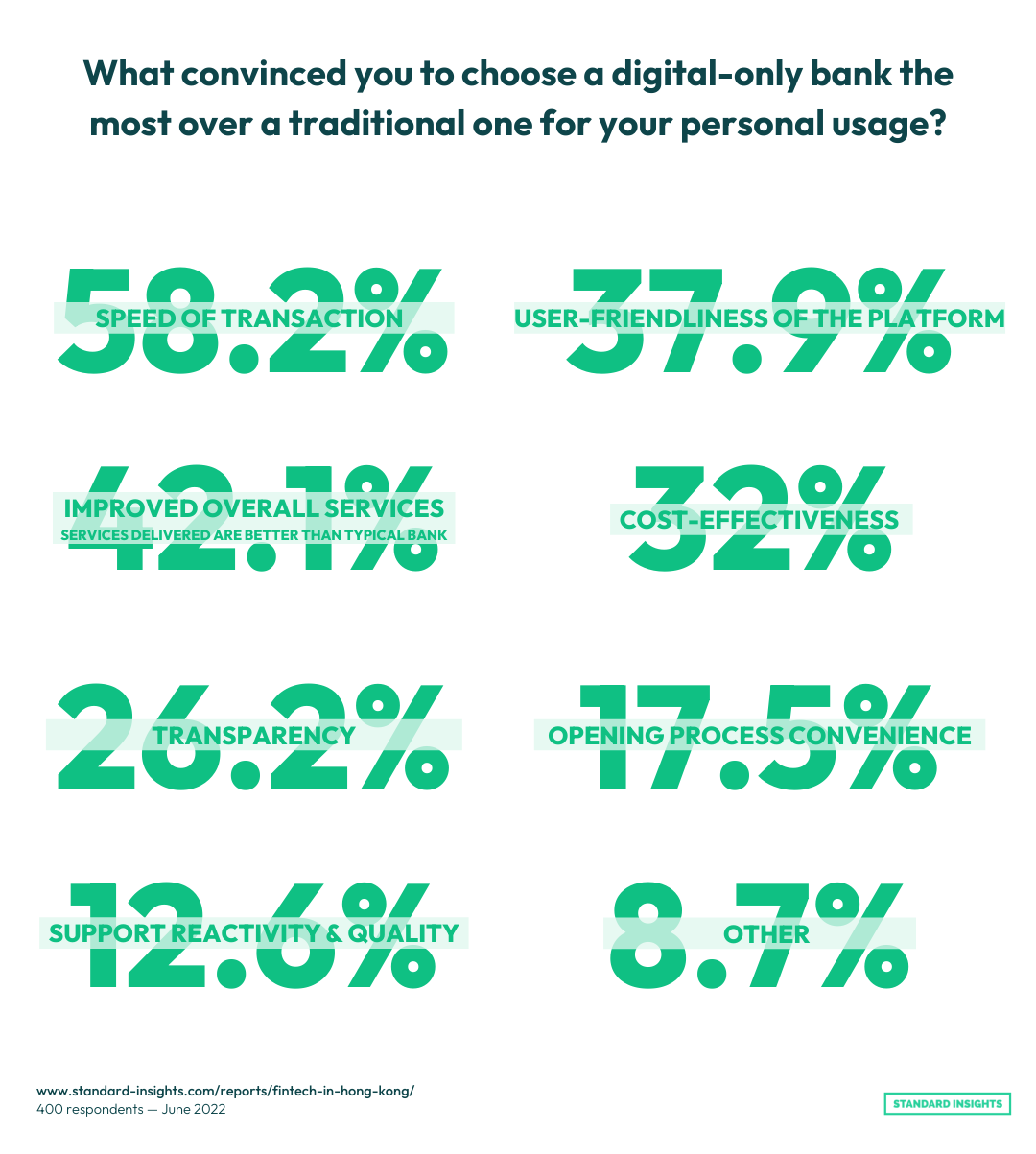

According to our survey, the following factors convince them to choose a digital-only bank over a traditional counterpart for their usage:

- The speed of transactions

- The quality of services received for the account’s cost

- The platform’s user-friendliness

Based on our survey, the trust and reputation of the bank is the most crucial factor when considering opening a bank account. Therefore, bank branches should figure out strategies that help leverage the bank’s awareness and trustworthiness besides the user experience features mentioned above.

Wrap Up

In recent years, Hong Kong’s banking sector has led the way in fintech adoption, bringing a wider range of digital services to consumers. Usage of tools like the Faster Payment System (FPS) continues to rise, reflecting this rapid transformation.

Support from the HKMA has created a strong foundation for innovation, with ongoing focus on areas like consumer protection and cybersecurity.

As fintech continues to reshape the industry, keeping pace with changing consumer expectations is more important than ever. Use these insights to refine your strategy and meet the needs of today’s digital-first customers.