Bring your brand at the top of the market

Track your brand and competitors accurately with Insights from your target audience.

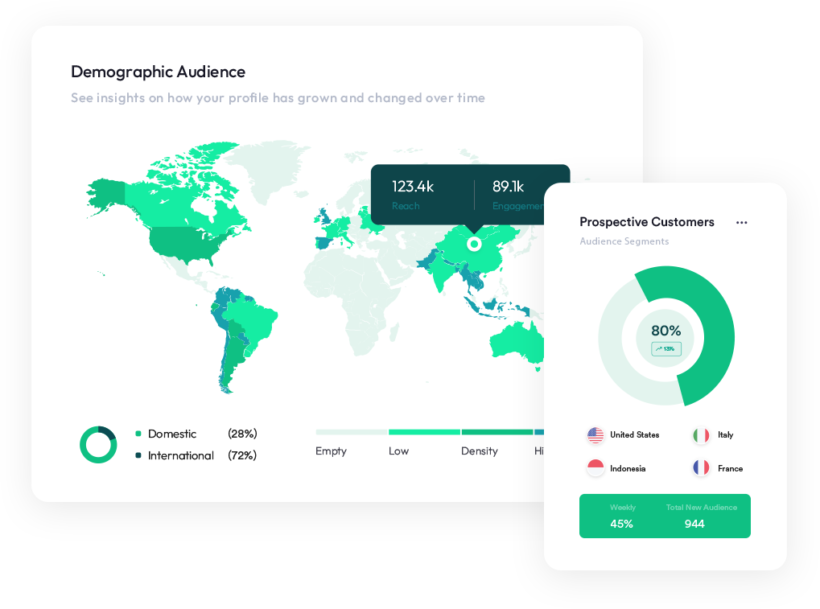

Monitor exactly where your brand stands against four competitors with reliable monthly feedback from verified active category consumers

Trusted by Leading Brands:

No live benchmark, no idea if the needle moved yesterday or last quarter.

Wins don’t stack because you don’t measure what matters—consistently.

You hop from ad hack to promo trick without data to guide the next move.

Continuous brand tracking shows what’s working today, so you can grow market share tomorrow.

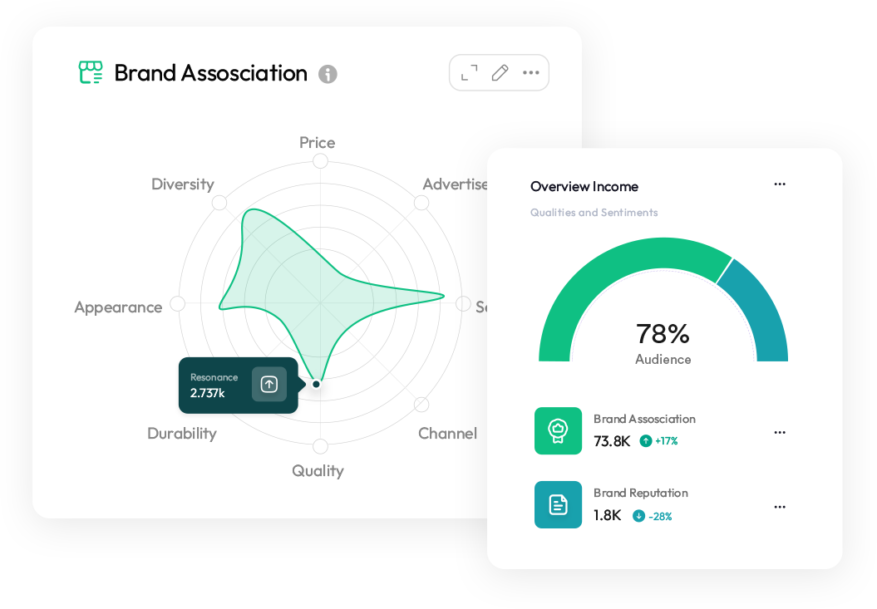

Among the 20 metrics, here’s what you’ll actually discover:

See exactly where you’re winning and losing against competitors. No more guessing if your positioning is working—you’ll have the data to prove it.

Discover which brand attributes drive sales and which send prospects running to competitors. Know exactly what to amplify in your messaging.

Find the exact conversion barriers costing you sales. Pinpoint where prospects drop off and what would make them choose you instead.

Focus your budget on segments with genuine growth potential. Stop wasting resources on demographic groups with limited returns.

Imagine knowing exactly where to focus your marketing dollars for maximum ROI—which messages to amplify, which audiences to target, and precisely what changes would drive the most growth. What could you achieve with that level of clarity?

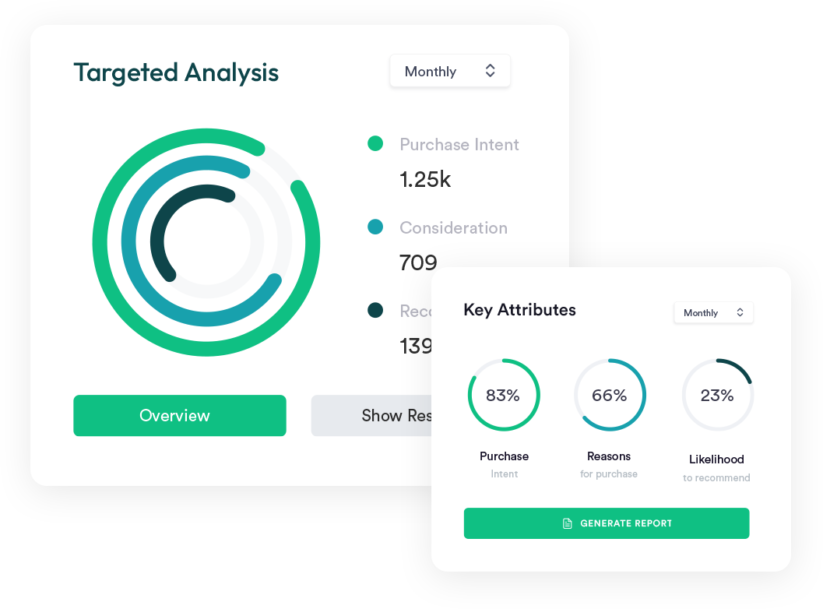

Simple, fast, and guaranteed on-time delivery.

Choose markets, rivals, audience, and custom questions—our team does the rest.

We survey real category buyers who match your target profile.

Your dashboard is live in 14 days. Manipulate the data, export it, present it.

Choose the option that’s right for your brand

From $19,990 /year

Starting $3,990 one-time payment

Want to know if brand tracking is worth it? Try our ROI Calculator

Final price may vary based on your market, frequency, and add-ons. See details or talk to us for a custom quote.

Every respondent is a verified category purchaser or we replace them at our cost. Your insights are based on real, active buyers in your market.

Not every brand needs tracking. Here’s how to know if yours does.

Brand tracking is also not for you if:

Still unsure? Book a call or send us an email at marketing@standard-insights.com

Track your brand and competitors accurately with Insights from your target audience.

If you can’t find what you’re looking for, feel free to reach out!

Absolutely. We’ll tailor your sample size to your specific market. While 3600 respondents is our sweet spot for most brands, luxury or niche products might need fewer, while broad FMCG categories might need more. We’ll recommend the perfect fit based on your category and goals.

Depending on how niche your target is, we either:

Every participant must match your screening criteria and pass a 10-step validation process—attention check, red-herring question, geolocation test, IP-duplication check, bot trap, and more. – See our methodology

Anyone who fails is replaced at our cost. That’s the Every Voice Quality Guarantee

Yes—don’t waste good data. If you’ve already invested in survey-based research, we can import it into our platform so you can maintain continuity and track performance over time. Book a call or email us to verify compatibility with your existing datasets.

We field studies in 150+ countries and can drill down to states, provinces, or cities where panels allow. If a location is out of reach, we’ll tell you before you pay a cent.

Three drivers:

Add-ons—extra countries, custom segments, or more questions—are quoted case by case.